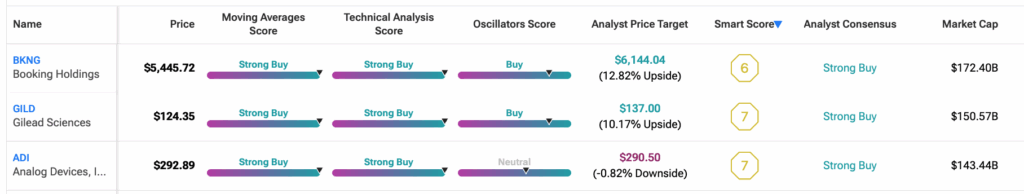

As markets remain shaky, technical analysis helps investors find good stock opportunities. Using TipRanks’ Technical Analysis Screener, we have identified three stocks, Booking Holdings (BKNG), Gilead Sciences (GILD), and Analog Devices (ADI), that are currently flashing Strong Buy signals. These stocks are showing bullish momentum and present short- to mid-term upside potential, backed by Strong Buy ratings from Wall Street analysts.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Notably, technical analysis studies a stock’s past price movements and trading volume to predict future trends. It uses tools like moving averages, RSI, and chart patterns to identify Buy or Sell signals. Within this context, TipRanks’ Technical Analysis tool simplifies this process by combining multiple indicators into one easy-to-understand dashboard for users. Let’s dive into the details.

Is Booking Holdings a Good Stock to Buy?

Booking Holdings is a global online travel company, connecting travelers with flights, hotels, and rentals worldwide.

According to TipRanks’ technical analysis, the stock is currently in an upward trend. It holds a Strong Buy rating based on overall technical consensus. BKNG stock also holds a Strong Buy rating based on moving average consensus, supported by all 12 bullish signals, indicating strong upward momentum.

Is Gilead a Good Stock to Buy?

Gilead Sciences is a biopharmaceutical company that develops and markets treatments for HIV, oncology, and other serious diseases.

According to TipRanks’ technical analysis, GILD stock holds a Strong Buy rating based on overall technical consensus and moving average consensus. One key indicator, the Rate of Change (ROC), which tracks momentum by measuring the percentage change in price over a set period, currently stands at 4.69 for GILD stock. Since an ROC above zero suggests upward momentum, this signals a Buy for the stock.

Is Analog Devices Stock a Buy?

Analog Devices is a global semiconductor company that designs high-performance chips used in industrial, automotive, and communications systems.

From a technical analysis perspective, ADI stock is rated a Strong Buy based on moving average consensus, backed by 12 bullish signals, showing strong upward momentum. ROC currently stands at 5.20 for ADI stock, which signals a Buy.