Financial firm Bank of New York Mellon’s (BK) stock soared today after releasing a robust Q4 2024 earnings report. Adjusted earnings per share of $1.72 beat Wall Street’s estimate of $1.54. It also represents a 33% increase year-over-year from $1.29 per share. This comes alongside 2024 EPS of $6.03 and a record net income of $4.3 billion.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Adding to this is revenue of $4.847 billion beating analysts’ $4.66 billion estimate. It’s also an 11.22% year-over-year rise in revenue compared to $4.358 billion. This strong growth resulted in the Bank of New York Mellon posting a record revenue of $18.6 billion in 2024.

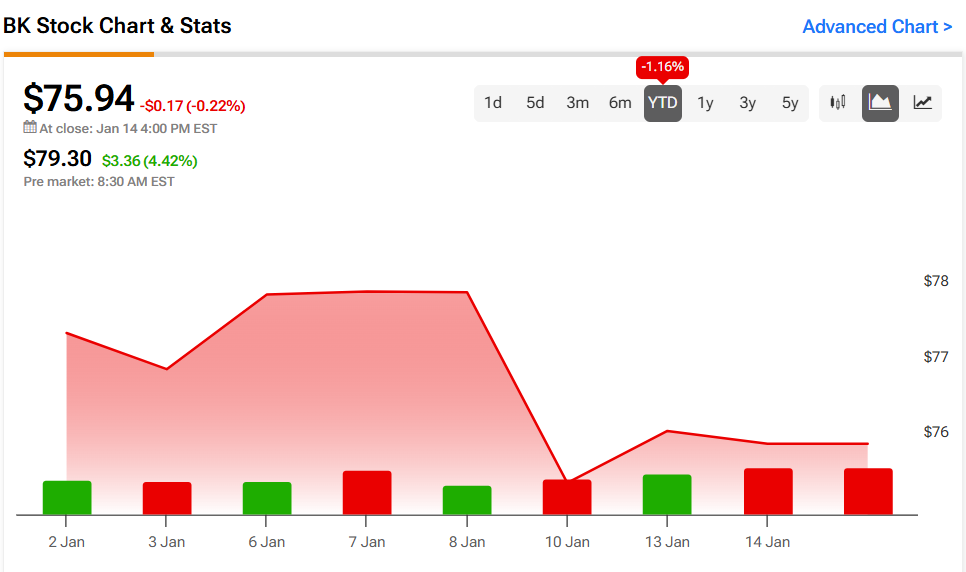

Investors are excited about today’s earnings beats with shares of BK stock up 4.42% as of this writing. That’s good news for shareholders and is a stark contrast to the start of 2025, which saw shares drop 1.16% year-to-date.

What’s Next for Bank of New York Mellon?

Bank of New York Mellon president and CEO Robin Vince said the firm enters 2025 with “strong momentum” and is on “the right path to unlock the opportunity embedded in our company.” This follows an accelerated transformation in 2024 through the launch of a new commercial coverage model, new products and solutions for clients, a brand refresh, its first acquisition in several years, and the phased transition to a strategic platforms operating model.

Is BK Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Bank of New York Mellon is Moderate Buy based on six Buy and five Hold ratings over the last three months. With that comes an average price target of $88.75, a high of $102, and a low of $79. This represents a potential 16.87% for BK shares. These ratings and price targets will likely change as analysts update their coverage of the company following its Q4 earnings release.