BitMine Immersion Technologies (BMNR) is officially the world’s largest publicly traded holder of Ethereum (Ether) (ETH-USD). In a Monday press release, the firm revealed that its treasury now commands 4,110,525 ETH, valued at approximately $12.1 billion. This massive stash places Bitmine second only to Strategy (MSTR) in terms of total corporate crypto holdings. Chairman Tom Lee noted that the company added over 44,000 ETH in the last week alone, capitalizing on “year-end tax-loss selling” to buy the dip.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

BitMine Targets The Alchemy of 5% Goal

The company’s ultimate objective is a strategy it calls the “Alchemy of 5%,” a mission to own 1 out of every 20 Ether tokens in existence. With a current share of 3.41%, BitMine is making rapid progress toward this milestone. This aggressive accumulation is designed to bridge the gap between Wall Street and on-chain infrastructure, positioning BitMine as a critical gatekeeper for the Ethereum ecosystem as institutional tokenization gains traction.

Bitmine Prepares The MAVAN Staking Launch

BitMine isn’t just holding tokens; it’s preparing to put them to work. The company is currently staking 408,627 ETH (worth roughly $1.2 billion) and plans to launch its proprietary Made in America Validator Network (MAVAN) in early 2026.

Lee estimates that once the entire treasury is fully staked at the current 2.81% rate, it could generate $374 million in annual revenue. This shift from a passive holder to an active network validator is expected to be a major topic at the company’s annual shareholder meeting on January 15, 2026, at the Wynn Las Vegas (WYNN).

Key Takeaway

The bottom line is that BitMine Immersion is successfully cornering the Ethereum market. By aggressively buying while others are selling for tax reasons, Tom Lee is ensuring the company stays on track for its 5% ownership goal. For investors, the upcoming January 15 meeting will be the moment to see if BitMine Immersion can successfully turn its massive treasury into the “best-in-class” staking infrastructure it has promised.

Is BitMine Immersion a Good Stock to Buy?

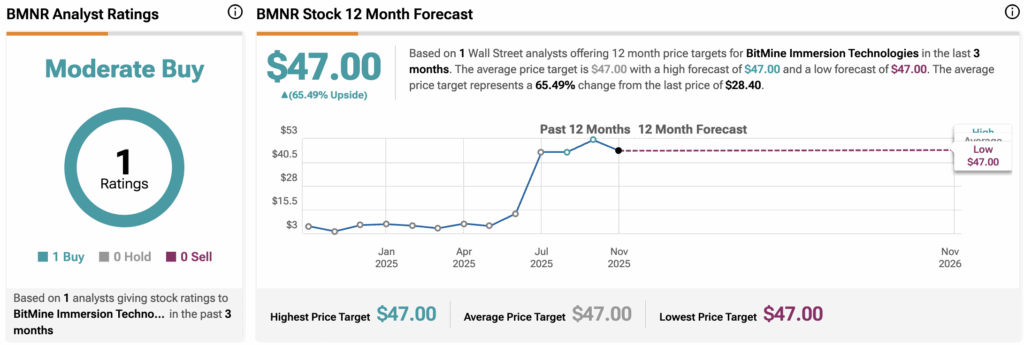

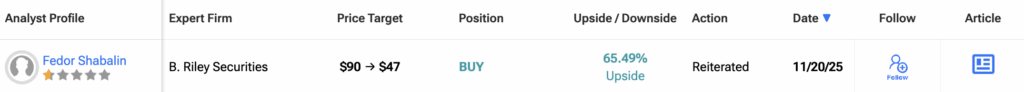

Currently, only one analyst from B. Riley Securities provides active coverage of the stock. This lone Buy rating comes with a staggering price target of $47.00, representing a potential 65.5% upside from current levels.