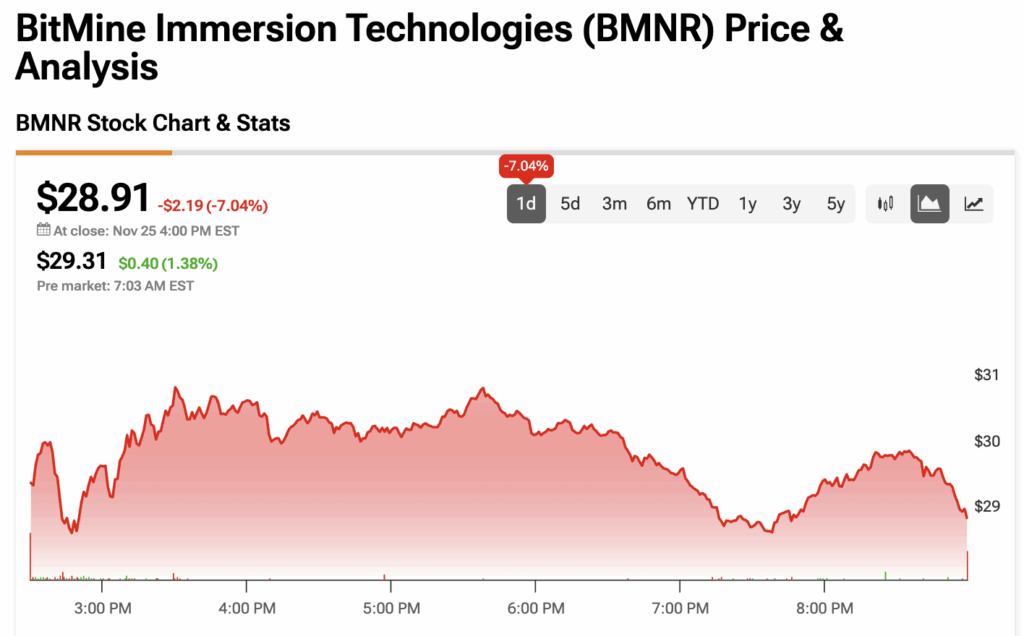

BitMine Immersion Technologies (BMNR) slipped 7% to $28.91 on Monday, a sharp reversal that came less than 24 hours after the company confirmed it had reached 60% of its long-stated goal to accumulate 5% of all Ethereum. The sudden move lower is drawing more attention than usual because BitMine has been one of the hottest crypto-equity trades of 2025, and profit-taking tends to hit the fastest climbers the hardest. Pre-market bids at $29.31 suggested early buyers were already stepping back in.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Investors Take Profits after a Rapid Run

The selling pressure appears to be a classic flush rather than a shift in the fundamental story. BitMine’s stock is still up more than 330% year-to-date, even after a 38% slide over the past month. Traders who rode that surge had plenty of incentive to ring the register as Ethereum spent the last week testing support near $2,500. The company’s aggressive accumulation strategy made it a high-beta proxy for ETH itself, and volatility tends to exaggerate every move.

Tom Lee, who leads BitMine’s treasury strategy, has been blunt about the current market environment. He said recent weakness reflects deteriorating liquidity and the same bearish chart signals seen since early October. He also argued that ETH’s slide toward $2,500 puts the downside in a narrow 5% to 7% range while the upside remains tied to what he calls a “supercycle ahead for Ethereum.” That framing helps explain why long-term holders are unfazed even as short-term traders hit the exits.

BitMine Builds Toward Its Next Catalyst

Despite the pullback, BitMine’s core numbers keep building. The firm now holds more than 3.6 million ETH, equal to roughly 3% of the supply, and management says the company remains on track to reach its 5% target. Fiscal 2025 net income reached $328 million, and the company plans to roll out Ethereum staking through its new MAVAN infrastructure early next year.

These catalysts matter because Monday’s drop did not come with any fundamental shift. It came because the market has been stretched, the stock had run ahead of itself and fast-money traders saw a chance to cash out. With BitMine still climbing toward its accumulation goal and new revenue streams approaching, long-horizon investors will see this as noise, not a narrative break.