The world’s largest corporate owner of Ether (ETH-USD) is not slowing down. This week, BitMine Immersion Technologies (BMNR) officially kicked off 2026 by purchasing another $105 million worth of the cryptocurrency. This move brings its total stash to more than 4 million tokens, meaning the company now controls over 3% of the entire global supply of Ether.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While many investors are nervous about the market, BitMine is sitting on a massive safety net. According to its latest financial update, the company still holds $915 million in total cash reserves. This extra money is ready to be used as BitMine chases its “Alchemy of 5%” goal, which is a plan to eventually own 5% of all Ether in existence.

BitMine Seeks Profits through Network Staking

BitMine isn’t just holding its tokens in a digital vault; it’s putting them to work. The company has already staked more than $2.87 billion of its Ether. Staking is a way for large holders to help run the network in exchange for rewards, essentially creating a steady stream of passive income.

To maximize these earnings, BitMine is building its own specialized system called the “Made in America Validator Network,” or MAVAN. Tom Lee, the company’s chairman, believes that once the full stash is staked through this new system, it could generate more than $1 million per day in fees.

BitMine Prepares for a Possible Market Dip

Despite the massive investment, the road ahead might be rocky. Tom Lee, who also helps lead Fundstrat Global Advisors, has warned that the first half of 2026 could see a “meaningful drawdown” to around $1,800 for Ether.

Rather than being scared by a potential 40% drop, the company views it as a chance to buy more. Lee noted in a recent message that such a low price would present “attractive opportunities into year-end.” This “buy the dip” mentality is shared by other major investors, often called whales, who have also been increasing their positions recently.

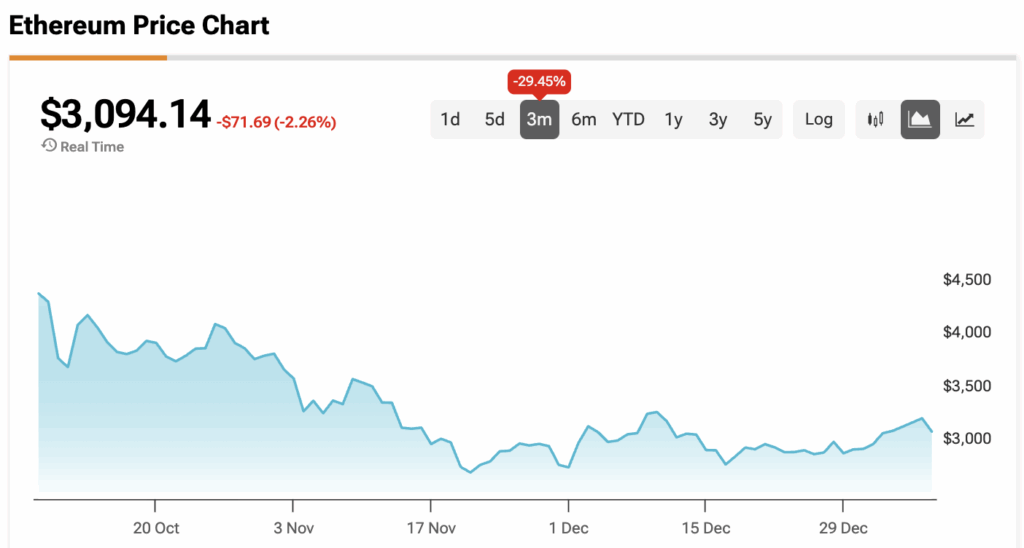

At the time of writing, Ethereum is sitting at $3,094.14.