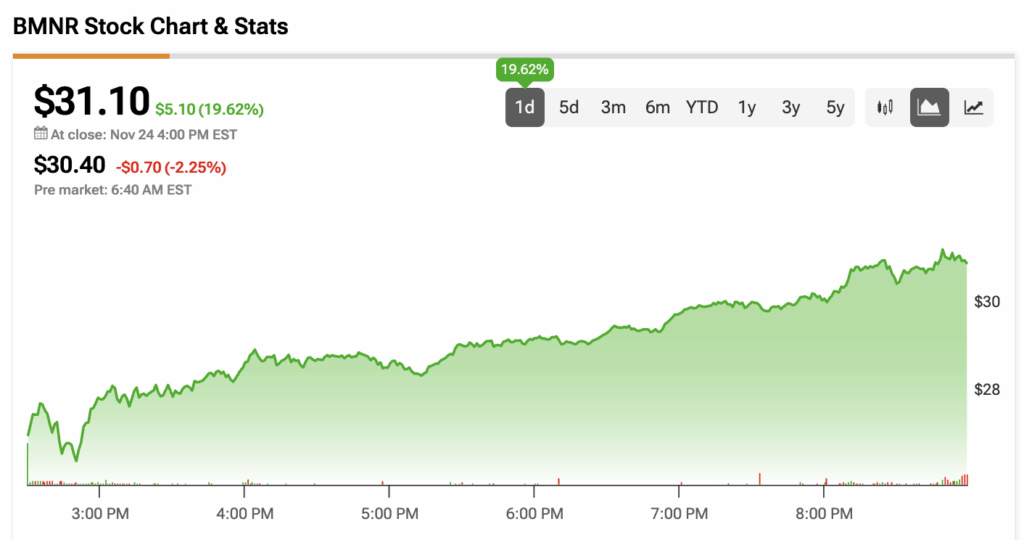

BitMine Immersion Technologies (BMNR) tore almost 20% higher into Monday’s close after revealing that its Ethereum holdings have crossed a major milestone. The Thomas “Tom” Lee–led company now holds more than 3.6 million ETH, representing about 3% of the total supply and 60% of its goal to own 5% of all circulating Ethereum. The disclosure, shared through Yahoo Finance, immediately reset sentiment around a stock that has endured a rough month but still stands among 2025’s top performers.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The rally put BMNR back on traders’ radars as crypto-equity sentiment broadly improved. Strategy (MSTR) added 5%, Coinbase (COIN) climbed 6%, and MARA Holdings (MARA) jumped 11%. Even after a 38% slide over the past month, BitMine remains up an eye-popping 330% year-to-date, handily outperforming nearly every digital-asset index.

BitMine Accelerates Its Ethereum Accumulation

BitMine has spent all of 2025 proving that market weakness does not deter its strategy. The company has continued building its stack through rallies, corrections, and high-volatility unwinds, steadily tracking toward its ambitious plan to own 5% of all ETH.

Tom Lee said the recent downturn aligns with weakening liquidity conditions that began in early October. He described the selloff as consistent with bearish chart structure rather than a failure of fundamentals. Lee added that BitMine’s internal models projected a downside floor near $2,500, which ETH has now approached. He argued that the remaining risk is small compared with the “supercycle ahead for Ethereum,” highlighting a risk-reward skew he believes now favors buying.

BitMine also reported $328 million in FY25 net income, giving the firm operational momentum alongside its accumulation strategy.

BitMine Prepares to Launch Staking Through MAVAN

The company is preparing to activate Ethereum staking through its MAVAN infrastructure in early 2026. Pilot programs with leading institutional staking providers have already begun, positioning the company to start generating yield on its massive reserves.

Adding staking revenue would mark a major shift in BitMine’s model. Instead of merely holding the asset, the firm will soon be able to generate recurring income from its ETH base, potentially strengthening its treasury and giving Wall Street a new vector for valuation.

Key Takeaway

BitMine’s fast climb toward its Ethereum goal is giving the stock real support, even while the rest of the crypto market struggles. The company now holds more than 3.6 million ETH, and hitting 60% of its long-term target has reminded investors why BMNR has been one of 2025’s strongest performers. The stock is still volatile, but BitMine’s steady buying, new staking plans, and clear strategy keep the focus on growth rather than fear.