BitMine Immersion Technologies stock (BMNR) plunged almost 11% this morning. Tom Lee, chairman of BitMine and co-founder of Fundstrat, is pointing to a very specific culprit behind crypto’s recent pressure: market makers who took heavy damage during the Oct. 10 liquidation event.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Speaking with CNBC, Lee said the $20 billion wipeout “caught some market makers off-guard,” leaving them with serious balance-sheet issues. Since they have less capital to work with, they’ve started shrinking operations at the exact moment the market needs more liquidity, not less.

“And if they’ve got a hole in their balance sheet that they need to raise capital, they need to reflexively reduce their balance sheet, reduce trading. And if prices fall, they’ve got to then do more selling. So I think that this drip that’s been taking place for the last few weeks in crypto reflects this market maker crippling,” he said.

This forced selling is what Lee believes is weighing on Bitcoin, Ethereum and crypto-linked equities.

Lee Compares Market Makers to Crypto’s ‘Central Bank’

Lee didn’t soften the analogy. He said market makers are as essential to crypto as monetary authorities are to traditional finance. “Market makers are critical in crypto because they provide liquidity. I mean, they act almost as the central bank in crypto,” he said.

When those players are impaired, the entire market struggles to function. This is why Lee warns that price weakness may linger a bit longer, not because fundamentals are broken, but because the liquidity engine is wounded.

He also pointed out that the stock market appears to be echoing the same pattern that followed the Oct. 10 crash. “Today’s stock market looks a lot like an echo of what happened on October 10th. But on October 10th, that liquidation was so big […] it really crippled market makers,” he said.

Crypto Faces a Few More Weeks of Unwinding

Lee expects the cleanup process to take time. He referenced a similar episode in 2022 that required nearly two months to stabilize. “And so in 2022, it took eight weeks for that to really get flushed out. We’re only six weeks into it,” he said.

Bitcoin was trading above $121,000 before the crash and has since dropped back near the $86,900 area. Ethereum and the rest of the market have followed the same path. Lee argues this reflects liquidity stress, not a broken cycle. “I think crypto, Bitcoin and Ethereum are in some ways a leading indicator for equities because of that unwind. And now this sort of limping and weakened liquidity,” he said.

BitMine Sits at the Center of This Liquidity Story

BitMine, now one of the world’s largest Ethereum treasuries, is operating inside the same liquidity environment Lee is describing.

Its stock, like the broader crypto-equity sector, has stalled under the weight of market-maker selling and ETF outflows. But Lee’s explanation frames that weakness less as a signal of failing demand and more as a temporary liquidity event that needs time to clear.

For investors watching the stock or the treasury strategy, it could be reassuring to know that the stress comes from the plumbing of the market, and not the long-term view of ETH or BTC. If Lee’s timeline is right, this pressure may ease in the weeks ahead.

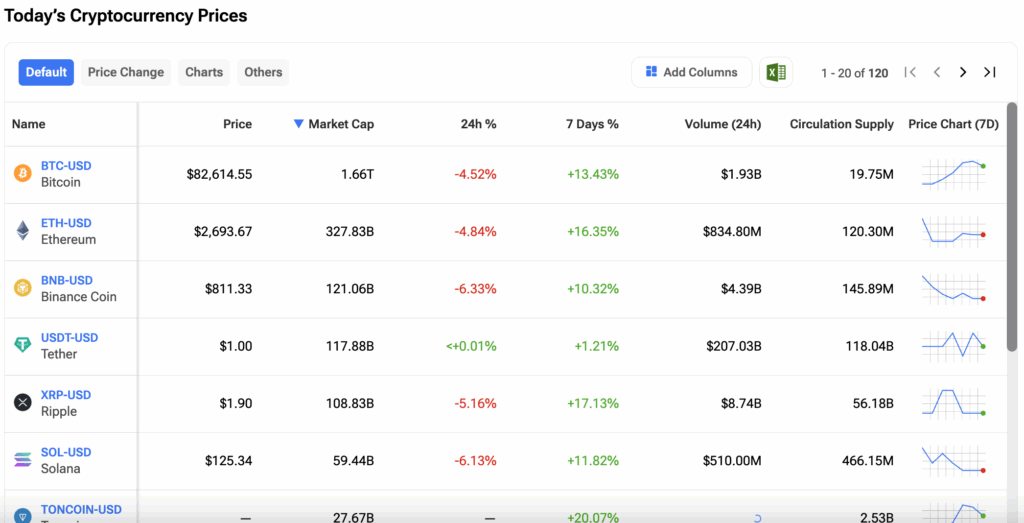

Investors should stay informed by tracking the prices of their favorite cryptos on the TipRanks Cryptocurrency Center. Click on the image below to find out more.