In January, Bitcoin reached a new all-time high of $109,340.21, which created both excitement and uncertainty in the cryptocurrency market. This led to mixed reactions from investors who bet against crypto-related stocks (known as short sellers). Some stocks saw an increase in short interest, while others saw a decrease. Short interest is a measure of how many investors are betting against a stock, and it can indicate market sentiment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

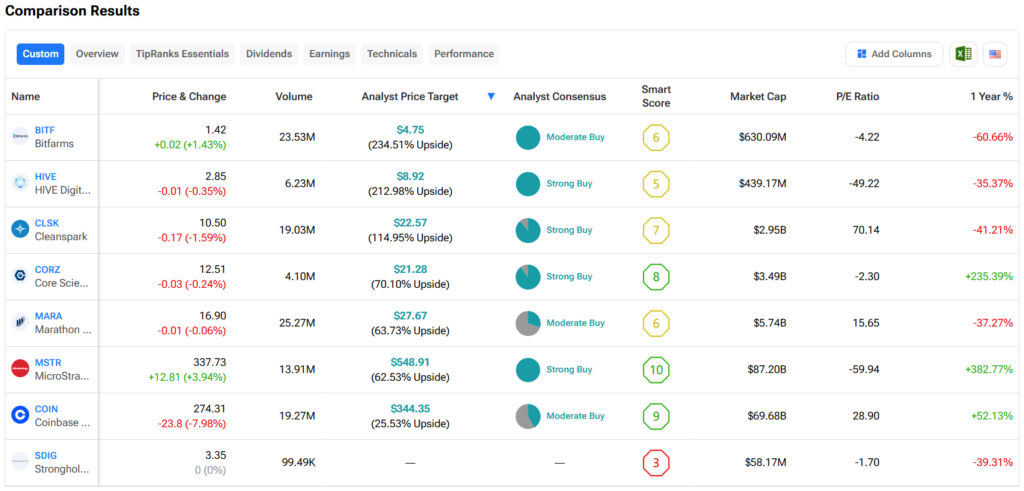

Some notable stocks that saw an increase in short interest include Strategy (MSTR), CleanSpark (CLSK), Bitfarms (BITF), and HIVE Digital Technologies (HIVE), which rose to 10.02%, 26.48%, 16.15%, and 4.20%, respectively. On the other hand, stocks like Coinbase Global (COIN), Mara Holdings (MARA), Core Scientific (CORZ), and Stronghold Digital Mining (SDIG) saw a decrease in short interest. This decrease could indicate that investors are becoming more optimistic about these companies’ prospects.

The total value of short bets on crypto stocks rose to $13.75 billion in January, up from $12.2 billion in the previous month. The top three stocks that attracted the most short interest were Strategy, Coinbase, and MARA Holdings, as they accounted for $11.56 billion of the total bets. This significant short interest suggests that investors are cautious about the cryptocurrency market’s volatility and regulatory uncertainty. However, it’s important to note that short interest can also be a contrarian indicator, which means that high short interest can sometimes occur before a stock rebounds.

Which Crypto Stock Is the Better Buy?

Turning to Wall Street, out of the stocks mentioned above, analysts think that BITF stock has the most room to run. In fact, BITF’s average price target of $4.75 per share implies more than 234% upside potential. On the other hand, analysts expect the least from SDIG stock, as it does not even have an average price target.