The current rally in Bitcoin (BTC) that has pushed its price as high as $94,000 is being driven by institutional investors, according to crypto exchange Coinbase Global (COIN).

In a media interview, Coinbase Global’s Head of Strategy John D’Agostino said that retail investors remain on the sidelines when it comes to cryptocurrencies. D’Agostino said that data shows institutional investors and sovereign wealth funds have been accumulating Bitcoin in recent weeks, pushing the price back above $90,000.

At the same time, retail investors continue to pull money from both spot Bitcoin and Ethereum (ETH) exchange-traded funds (ETFs). D’Agostino said the theory at Coinbase is that de-dollarization is driving institutional investors back into cryptocurrencies.

A Hedge Against Inflation?

Sovereign wealth funds and institutions are essentially turning to crypto as they reduce their exposure to the U.S. dollar. Also, Bitcoin and other cryptocurrencies appear to be decoupling from technology stocks that they once traded in tandem with, such as chipmaker Nvidia (NVDA).

Lastly, a growing number of institutions are beginning to accept that Bitcoin might be a hedge against inflation and are buying the digital asset for future downside protection. “Bitcoin is trading on its core characteristics, which are similar to gold,” said D’Agostino in speaking with CNBC.

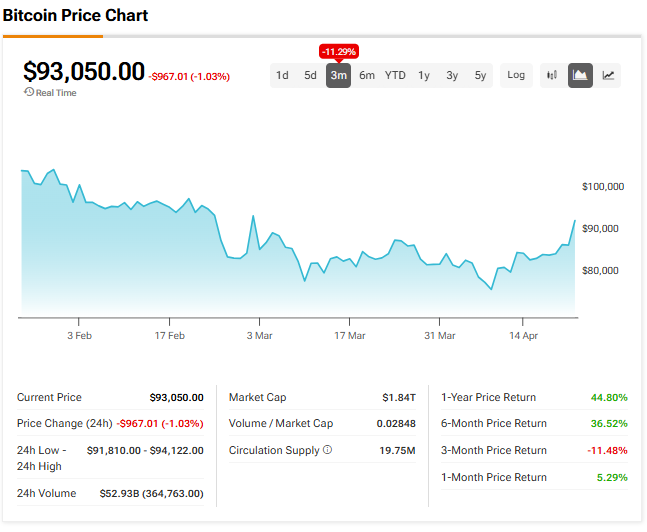

The price of Bitcoin is currently trading at $93,000.

Is BTC a Buy?

Most Wall Street firms don’t offer ratings or price targets on Bitcoin, so we’ll look at the cryptocurrency’s three-month performance instead. As one can see in the chart below, the price of BTC has declined 11.29% in the last 12 weeks.