The price of Bitcoin (BTC), the largest cryptocurrency by market capitalization, has fallen below $100,000 for the first time since June of this year as investors grow more risk-averse.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

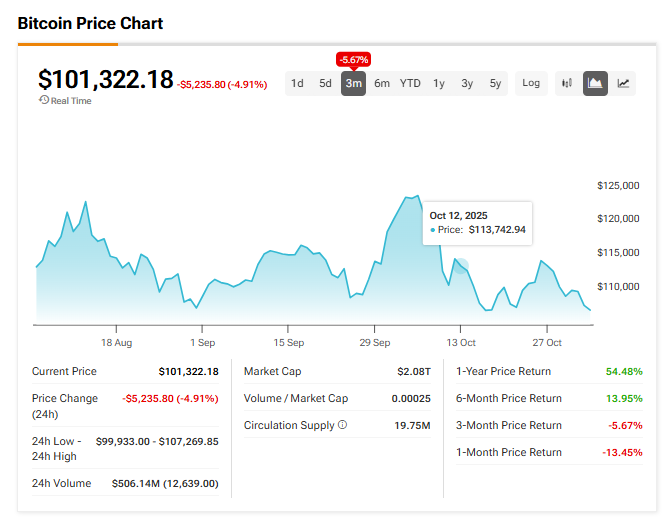

In afternoon trading on Nov. 4, Bitcoin fell as low as $99,966 per digital token and its price is down about 6% in the past 24 hours. Other cryptocurrencies are faring even worse, with Ethereum (ETH), the second-largest crypto, declining nearly 10% to trade as low as $3,296.

The worsening selloff in crypto comes amid a sharp pullback in U.S. stocks over worries about high valuations and the sustainability of the artificial intelligence (AI) trade. The Nasdaq index (NDAQ), comprised largely of technology stocks, was down nearly 400 points or 1.65% in afternoon trading on Nov. 4.

Continued Struggles

The slide in Bitcoin’s price continues a downward trend that has persisted since early October. Over the past month, BTC has fallen from an all-time high of just over $126,000. The decline has been surprising given that October has historically been the best month of the year for digital assets.

Yet Bitcoin suffered its worst October since 2018 as investors grow more cautious. Analysts say the ongoing U.S. government shutdown, a strengthening U.S. dollar, and a pullback in the price of gold are all weighing on the price of Bitcoin and other crypto.

Is Bitcoin a Buy?

Most analysts don’t offer ratings or price targets on Bitcoin. So instead, we’ll look at the three-month performance of BTC. As one can see in the chart below, the price of Bitcoin has fallen 5.67% in the last 12 weeks.