Bitcoin (BTC-USD) surged past $93,000 on Monday as investor sentiment improved following reports of U.S. strikes in Venezuela. Adding to the momentum, reports suggest Venezuela may hold roughly $60 billion worth of Bitcoin—an overhang that could influence Bitcoin prices and the broader crypto market in 2026. As of this writing, Bitcoin was up 2.53% on Monday, trading near $93,700.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, U.S. forces captured Nicolás Maduro and Cilia Flores in Caracas, Venezuela, on January 3 and flew them to New York on drug trafficking charges. President Trump said the U.S. would manage Venezuela until a safe transition, highlighting the country’s huge oil reserves. At the same time, critics question whether the drug charges are the real reason, given U.S. oil interests.

US Moves Spark Bitcoin Rally

Overall, Bitcoin has gained about 7% over the past five days, reaching a market capitalization of $1.86 trillion. Its 24-hour trading volume reached $33.9 billion. Analysts say the recent rally shows how sensitive Bitcoin is to global events and how it is increasingly seen as a hedge during geopolitical uncertainty. Overall, news from Venezuela created some short-term market swings, but it doesn’t alter Bitcoin’s core fundamentals.

Meanwhile, reports suggest Venezuela may secretly hold up to 600,000 Bitcoin, worth around $60 billion—similar to the holdings of Strategy (MSTR) and BlackRock (BLK). The Bitcoin was reportedly accumulated through gold deals and oil sales settled in crypto to bypass U.S. sanctions.

After the U.S. captured Maduro, attention has turned to recovering these assets. If seized, the Bitcoin could be frozen or added to a U.S. reserve, potentially tightening supply and supporting higher Bitcoin prices in 2026.

What Lies Ahead for Bitcoin?

As 2026 begins, Bitcoin is in a healthier position, with much of the heavy speculation cleared out. Over the past few months, traders have closed out a huge amount of leveraged Bitcoin and other crypto assets after speculative activity peaked in October. This reset gives Bitcoin and the broader crypto market more room to move naturally—and potentially higher—without the pressure of crowded, risky trades.

With speculation reduced, steady institutional interest, and rising geopolitical uncertainty, Bitcoin’s outlook remains positive.

Notably, Citi has a base-case target of $143,000 for Bitcoin over the next 12 months, citing the growing number of crypto ETFs and an increasingly favorable regulatory environment.

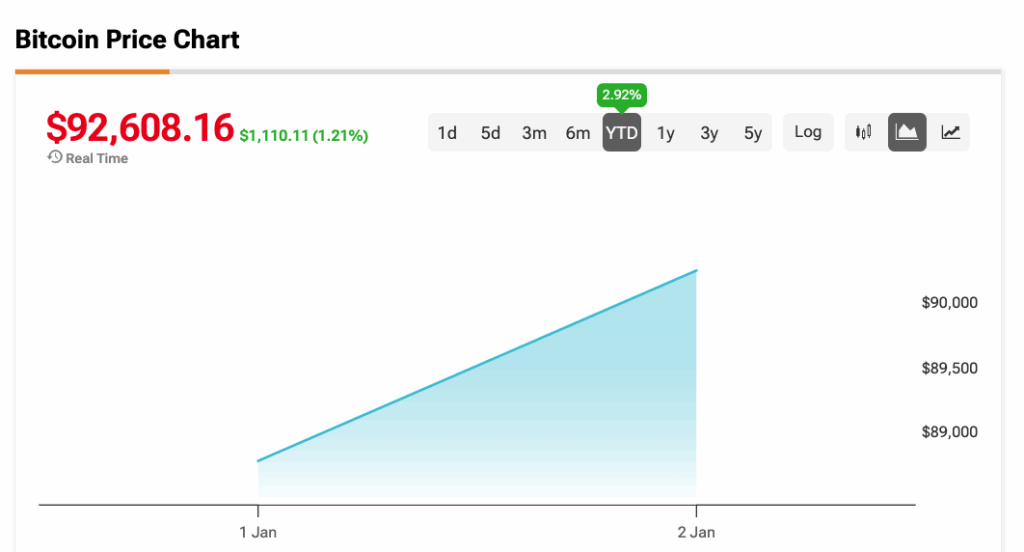

Year-to-date, BTC gained 3%.