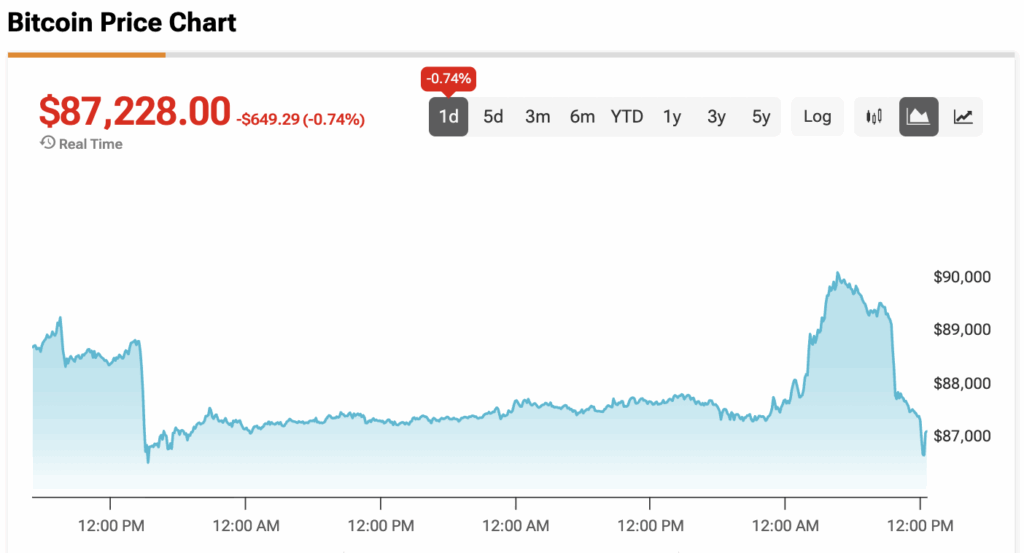

Bitcoin (BTC-USD) tokens traded near $87,193 on Monday as the cryptocurrency’s end-of-year rally hit a massive wall of resistance. Despite a surge in optimism earlier this month, the market is currently grappling with a “risk-off” approach from investors, leading to a sharp decline in on-chain activity. To spark a true New Year rally toward $100,000, analysts warn that the “Apparent Demand”—a key metric that measures new Bitcoin production against coins moving out of long-term storage—must flip back into the green to clear the psychological hurdle at $90,000.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Bitcoin Apparent Demand Flips Negative for the First Time Since October

The most concerning metric for bulls is the sharp reversal in Bitcoin Apparent Demand. After peaking at roughly 18,700 BTC in late November, the metric has plunged to -3,491 BTC, its lowest level since October 21. This negative reading suggests that the “buying fatigue” is real, as traders pull back ahead of the 2026 calendar year. Without a return of net-positive demand, the price risks being pinned below its yearly open of $93,300, which would mark a rare “red” year following a halving event.

The Coinbase Premium Index Signals Heavy U.S. Selling

Adding to the tension is the Coinbase (COIN) Premium Index, which has “tanked to the current value of -0.08.” This index measures the price difference between Coinbase (U.S. retail) and Binance (Global), and the current deep red bars indicate that American selling pressure is outweighing global demand.

Analyst Mv_Crypto warned on X that “The Coinbase $BTC Premium Index is still printing deep red bars, signalling that US selling pressure hasn’t lifted yet,” adding that “Until this metric recovers, approaching the long side requires extreme caution.”

Technical Setup Points to a Target of $122,000

Despite the short-term gloom, a massive technical breakout may be brewing. Analysts point to a “descending broadening wedge” on the eight-hour chart, with the upper trendline sitting right at $90,000. If bulls can reclaim the $90,000–$92,000 zone, the “measured target” of this pattern sits at $122,000.

Analyst Jelle noted that a monthly close above $90,360 would lock in a “hidden bullish divergence,” stating, “Bitcoin needs to end the month in the green to lock in; close above $90,360 and we’re golden.”

At the time of writing, Bitcoin is sitting at $87,228.