The crypto world thrives on bold predictions. This week Arthur Hayes delivered the boldest yet. The former BitMEX CEO said Bitcoin is on track to hit $1 million by 2028. He laid out his argument in a May 15 blog post explaining why the next global macro moves could send Bitcoin into orbit.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Hayes believes two forces are lining up to propel Bitcoin to the moon. First is the accelerating repatriation of foreign capital as global investors rush into hard assets. Second is what he calls the “devaluation of the gargantuan stock of U.S. Treasurys.”

These two catalysts are what he claims will make Bitcoin the ultimate safe haven. “Foreign capital repatriation and the devaluation of the gargantuan stock of U.S. Treasurys will be the two catalysts that will power Bitcoin to $1 million sometime between now and 2028,” Hayes wrote.

Hayes Warns Europeans to Get Out Before Capital Controls Tighten

Hayes did not stop there. He aimed his warning squarely at Europe. According to Hayes, signs of tightening capital controls are already flashing red across the continent. He warned that governments will likely clamp down on retail crypto ownership.

In typical Hayes style, he did not pull punches. “For you Euro-poor-peans, whose governments practice a less effective form of communism than China, don’t expect the European Central Bank (ECB) to learn this lesson without trying,” Hayes said. “Therefore get your money out now.”

Bitcoin ETFs and Whale Activity Strengthen the Case

Hayes’ bold prediction comes as Bitcoin continues to show strength. The price surged to $106,000 this week off the back of massive ETF inflows.

Glassnode reported that spot Bitcoin ETFs pulled in $2.9 billion in net inflows in just two weeks. History shows these inflows often trigger major rallies. That was the case last year when Bitcoin ran from $67,000 to $108,000.

The buying frenzy has also spread to the whales. Wallets holding between 10 and 10,000 Bitcoin have quietly scooped up another 83,105 BTC in the last 30 days, according to Santiment. That wall of demand has added serious fuel to Bitcoin’s latest surge.

Bitcoin Bulls Set Sights on $140,000 as Next Target

Now the market is wondering where Bitcoin goes next. Technical analysts say Bitcoin is flashing signs of a $140,000 breakout.

Crypto investor Ted Boydston pointed to the Bitcoin transaction volume Z-score approaching 1, a level that in past cycles signaled a new parabolic move. “Bitcoin should be full bull once the Z-score breaches 1,” Boydston said.

Meanwhile, Bitcoin balances on exchanges have plunged to a six-year low. Investors appear to be moving coins into self-custody wallets as they brace for further price gains.

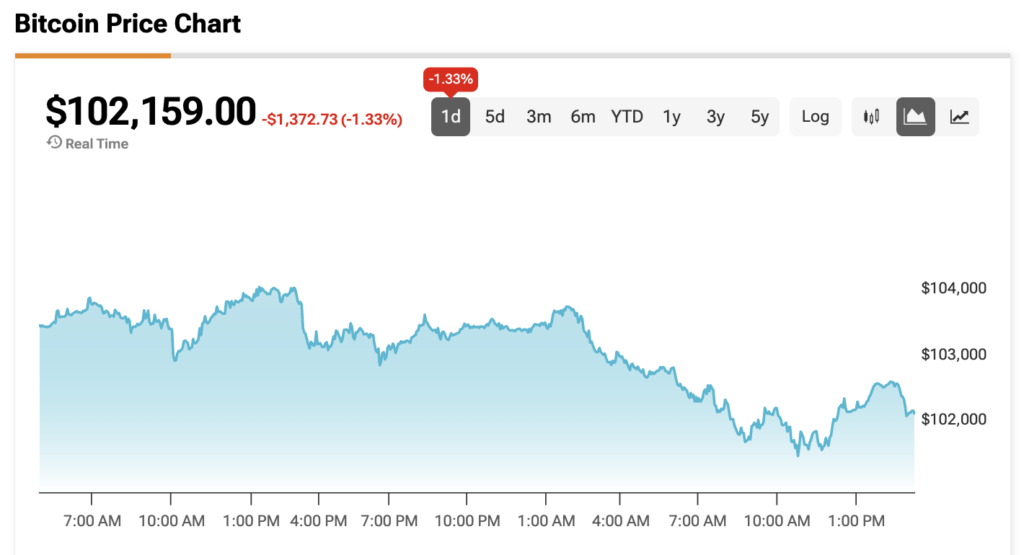

The combination of whale accumulation, ETF buying, and tightening supply has traders preparing for Bitcoin’s next big leap. At the time of writing, Bitcoin is sitting at $102,159.