While most of Wall Street is nursing a 2025 hangover, Tom Lee is looking at the clock. On January 5, 2026, the Fundstrat co-founder used a CNBC appearance to argue that Bitcoin (BTC-USD) has yet to peak. Despite the rocky end to last year, Lee believes the current reset is just a digestion phase before a massive push to a new record this month.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The market logic here is focused on a “year of two halves.” Lee is warning that the first six months of 2026 will be defined by institutional rebalancing and high volatility. However, he remains adamant that these short-term shocks are exactly what set the stage for the massive rally expected in the back half of the year.

Bitcoin’s Success Is Tied to the Broader Economy

Lee’s call for a January Bitcoin record is tied directly to the fundamental strength of the broader economy. He projects the S&P 500 (SPX) will hit 7,700 by the end of 2026, fueled by AI-driven productivity and a more dovish Federal Reserve. In Lee’s view, the same wall of skepticism that kept investors away from stocks in 2025 is now building for crypto, creating a coiled spring effect.

The logic is that Bitcoin and equities are riding the same liquidity trend. As corporate earnings show resilience and the Fed moves toward rate cuts, risk assets typically move in short, explosive bursts. For Bitcoin, which hit $126,000 in October before pulling back, the path to a new high is simply a matter of the market catching up to these macro tailwinds.

Lee Believes Ethereum Is Highly ‘Undervalued’

Perhaps his more ambitious claim is that Ethereum (ETH-USD) is “dramatically undervalued” and entering a supercycle reminiscent of Bitcoin’s 2017–2021 run. Lee isn’t just talking; his firm, Bitmine Immersion Technologies (BMNR), has been aggressively buying. The company now holds 4.14 million ETH, representing roughly 3.43% of the entire token supply.

Lee frames this massive accumulation as a “strategic necessity” rather than a gamble. He argues that for any modern treasury, holding an asset that can appreciate by ten times is a requirement to stay competitive. His decision to position Bitmine as a major validator through the upcoming MAVAN network suggests a bet that the tokenization of Wall Street assets, like real estate and credit, will eventually flow through Ethereum, making the current price a major entry point.

Key Takeaway

The takeaway from Lee’s 2026 outlook is that volatility is the price of admission for outsized gains. While he expects near-term turbulence as institutions reset their books, the long-term logic remains bullish. If Bitcoin hits a new high in January as predicted, it would prove that the 2025 pullback was a correction, not a peak, and set a high bar for the rest of the year.

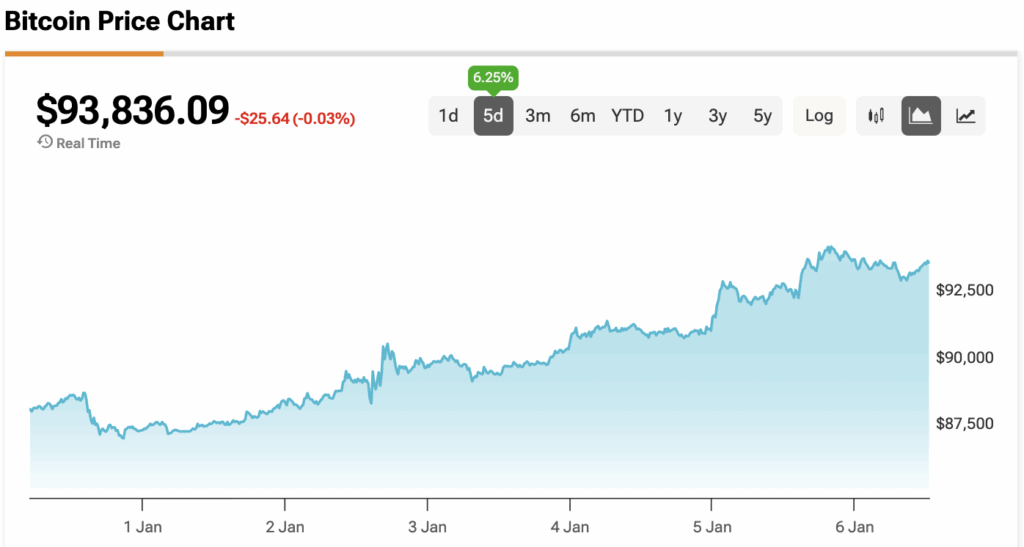

At the time of writing, Bitcoin is sitting at $93,836.09.