Middle East tensions have shaken the crypto market, as Bitcoin ETFs face massive outflows amid rising unrest. Institutional investors pulled nearly $243 million from U.S. spot Bitcoin exchange-traded funds on Oct. 1, according to data from Farside Investors. This move reversed an eight-day streak of inflows totaling $1.4 billion.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Leading Bitcoin ETFs Hit Hard

The Fidelity Wise Origin Bitcoin Fund (FBTC) lost $144.7 million—the largest outflow among the ETFs. The ARK 21Shares Bitcoin ETF (ARKB) saw $84.3 million withdrawn. Bitwise Bitcoin ETF (BITB) and VanEck Bitcoin ETF weren’t spared either, experiencing significant outflows of $32.7 million and $15.8 million, respectively.

BlackRock Stands Strong

Defying the trend, BlackRock’s iShares Bitcoin Trust (IBIT) recorded positive flows of $40.8 million, marking its 15th consecutive day without outflows. This suggests that some investors still see a silver lining despite the geopolitical storm.

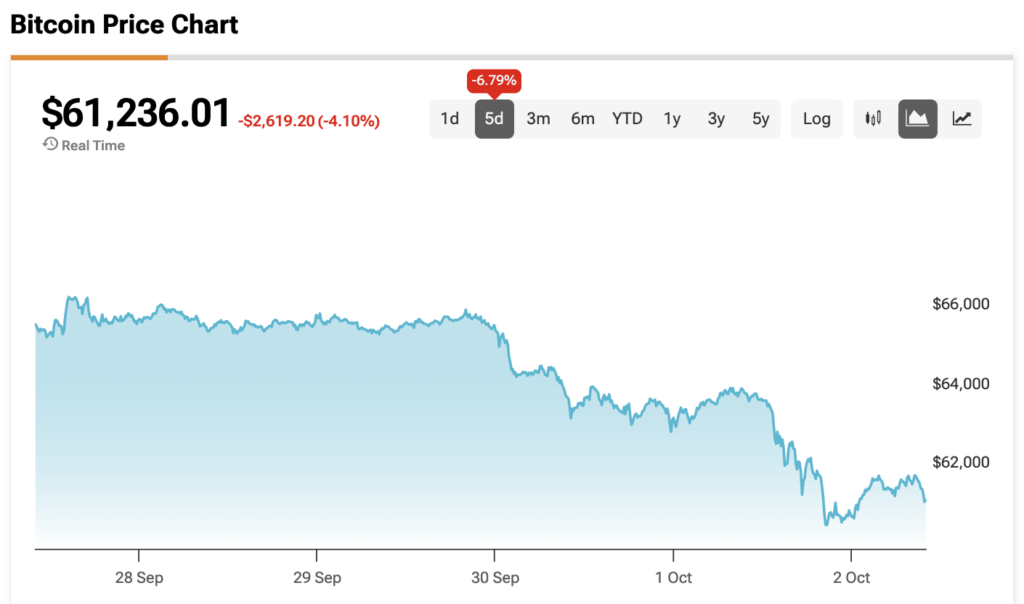

Bitcoin Price Dips After Iran’s Strike

Bitcoin’s (BTC-USD) price dropped nearly $4,000 following Iran’s missile attack on Israel on Oct. 1, hitting a two-week low of $60,315 before a slight recovery to $61,620, as reported at the time of publication.

Ethereum ETFs See Withdrawals Too

Nine U.S. spot Ethereum (ETH-USD) ETFs weren’t immune, registering combined outflows of $48.6 million. Grayscale’s Ethereum Trust (ETHE) led the decline, shedding $26.6 million. The Fidelity Ethereum Trust (FETH) wasn’t far behind, losing $25 million.

What Is the Price of Bitcoin and Ethereum Right Now?

At the time of writing, Bitcoin and Ethereum are sitting at $61,236 and $2,451, respectively.