Bitcoin sellers came back on Thursday as the price slipped to $111,000, putting renewed pressure on the market. Institutional demand for U.S. spot Bitcoin ETFs has softened, with inflows falling 54% last week to $931.4 million from $2.03 billion the week before, according to Glassnode.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

“While overall accumulation remains intact, the slowdown suggests a pause in institutional demand,” Glassnode said in a post on X.

This pullback stands in sharp contrast to early September, when steady inflows drove Bitcoin up 10% toward $118,000. Over just eight trading days, net ETF inflows topped $2.9 billion, including the largest single-day inflow in two months at $741 million. The shift shows how quickly institutional conviction can cool.

Retail Selling Adds to Pressure

The spot taker CVD indicator, which tracks the cumulative difference between buys and sells over 90 days, has stayed “taker sell dominant” since mid-August. In plain terms, retail traders have been selling more than buying, reinforcing the risk-off tone.

If this behavior continues, analysts warn Bitcoin could face a deeper correction heading into October. Price action now hinges on whether ETF flows rebound and whether the taker CVD trend finally flips positive.

Analysts Eye $90K If Key Support Fails

Market voices are increasingly bracing for more downside. “Not much strength on $BTC after a strong day yesterday,” MC Capital founder Michael van de Poppe said in a post on Thursday.

He argued that if Bitcoin breaks below the $112,000–$110,000 zone, it could tumble toward the $103,000–$100,000 range. “I would assume that we’ll be going to get some more downside and then we’re done for the current period, meaning that we’ll be in up-only mode,” he added.

Fellow analyst AlphaBTC pointed to Bitcoin’s descending channel and warned of a “deeper flush” toward $105,000–$100,000 if the current $112,000 support does not hold.

Glassnode also flagged a technical risk, noting BTC has slipped under its 0.95 quantile cost basis at $115,300. “Reclaiming it would signal renewed strength, but failure to do so risks a drift toward lower supports around $105K–$90K.”

What Investors Should Look Out for Next

For traders, the strategy hinges on two key signals. A rebound in ETF inflows could revive institutional demand and stabilize price action. On the flip side, sustained outflows combined with retail selling could confirm the bearish setup and extend the correction.

The double top pattern spotted on Bitcoin’s chart points to $90,000 as a possible destination if current support gives way. This leaves investors weighing whether this is another healthy shakeout before a bigger run higher or the start of a deeper reset.

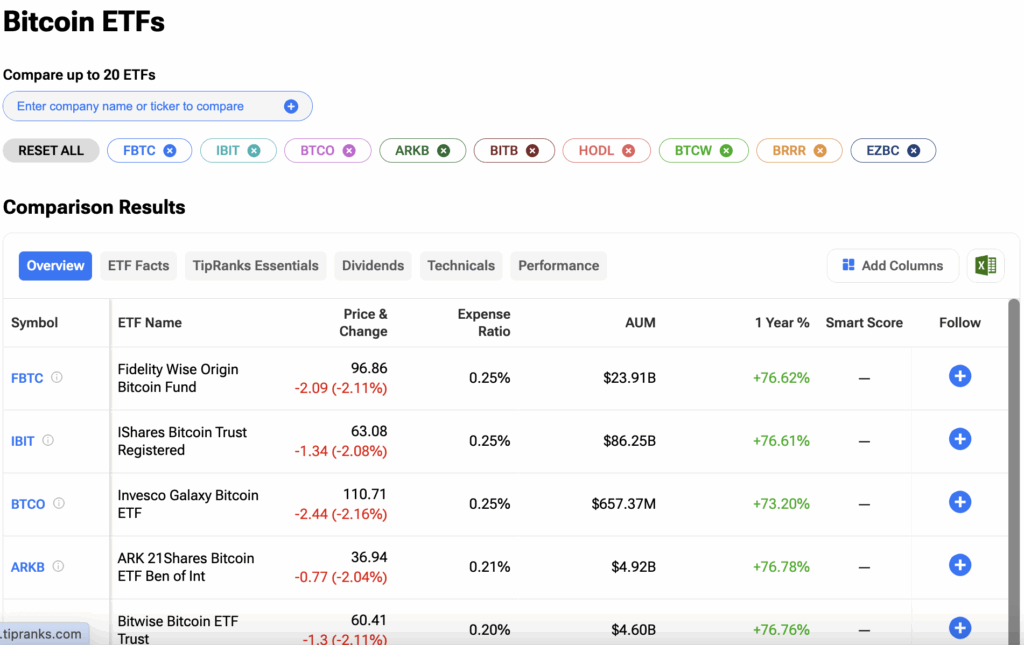

Investors can track their favorite Bitcoin ETFs on the TipRanks ETF Comparison Tool. Click on the image below to find out more.