Options trading on spot Bitcoin (BTC) exchange-traded funds (ETFs) could begin as soon as today (November 19), according to the Nasdaq (NDAQ) exchange.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The U.S. Securities and Exchange Commission (SEC) approved the listing of options for spot Bitcoin ETFs in September this year. Now, the Nasdaq exchange is saying that it plans to make options on spot Bitcoin ETFs available for trading.

In an interview with Bloomberg on November 18, Alison Hennessy, head of exchange traded product listings at Nasdaq said, “Our intent at Nasdaq is to list and trade these options as early as tomorrow.” While there are currently about a dozen U.S.-based spot Bitcoin ETFs, only BlackRock’s (BLK) iShares Bitcoin Trust (IBIT) is listed on Nasdaq and could therefore have options available to investors.

Attracting Institutional Investors

Analysts say that other Bitcoin ETF options are likely to follow the lead of Nasdaq in short order. Options are a form of derivative that allows investors to purchase or sell an underlying asset such as a Bitcoin ETF at a predetermined price within a specified period.

Options contracts are popular with professional traders because they allow them to hedge their positions and bet on the future direction of a tradeable asset such as a stock or ETF. The addition of options on spot Bitcoin ETFs is highly anticipated and expected to attract institutional interest to cryptocurrencies.

The price of Bitcoin is currently at $92,200, having increased 114% so far this year.

iShares Bitcoin Trust Performance

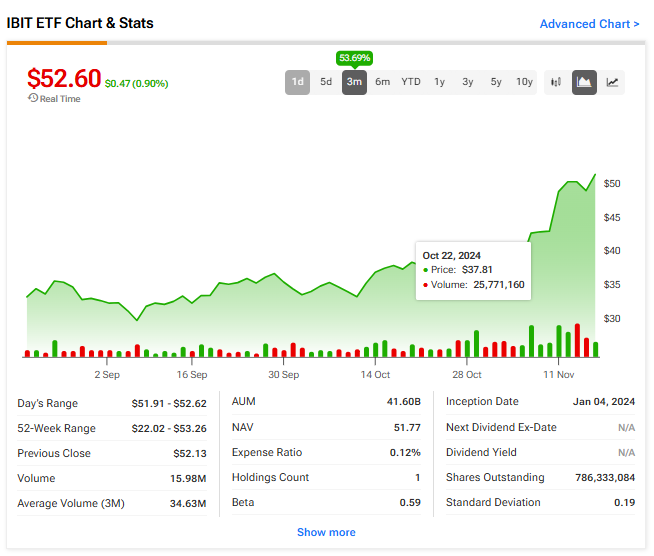

Wall Street analysts don’t provide ratings on cryptocurrencies or their ETFs. So instead we look at the three month performance of BlackRock’s iShares Bitcoin Trust. As one can see from the chart below, the IBIT ETF has risen nearly 54% over the last 12 weeks as inflows to the fund grow.