In today’s world of healthcare and medicine, something exciting is brewing. This is because the big pharmaceutical companies are actively acquiring biotech companies that are focused on developing innovative drugs and treatments. This trend is sparking renewed excitement among investors, who see these acquisitions as promising signs of growth and innovation in the biotech sector.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The acquisitions will help these pharmaceutical giants shore up their portfolios with new drugs and treatments, as many of their current patents are about to expire.

It’s important to highlight that back in 2021, the healthcare industry witnessed a surge, especially the biotech stocks, due to the ongoing pandemic and the search for new medical solutions. However, once the vaccine rollout began, biotech stock prices dropped back to their 2019 levels, as reflected by the SPDR Biotech ETF (NYSE: XBI).

Big Pharma Acquiring Innovation

This week, Dicephera (NASDAQ:DCPH), a promising oncology-focused biotech company, was acquired by ONO Pharmaceutical (TSE:ONO) for $2.4 billion. This follows on the heels of similar moves, such as Novartis’ (NYSE:NVS) licensing deal with Arvinas (NASDAQ:ARVN), and its takeover interest in Janux Therapeutics (NASDAQ:JANX).

These deals highlight the growing appetite of established pharmaceutical companies for the innovative therapies being developed by smaller biotech firms. These large pharmaceutical companies cannot let too many years pass without generating new revenue and replenishing pipelines because existing drugs lose patent exclusivity. So if they don’t acquire new innovation, it would be like having a winning Major League baseball team one year and deciding not to replace strong but aging players for a period of several years.

Also, the acquisition competition can heat up at any time, as big pharma as an industry is said to have a record amount of capital set aside for acquisitions and partnerships.

Yet another strong reason for the M&A uptick is an increase in Food and Drug Administration (FDA) approvals of new therapies last year. Approvals rose 50% last year, from 37 in 2022 to 55 in 2023.

Biotech Continued Strength

It’s like the biotech sector has just emerged from a three-year rest and is now gearing up for action. According to an industry publication, Genetic Engineering & Biotech News, the positive momentum in the biotech sector should continue, suggesting strong M&A activity in 2024. While not an investment publication, it’s noteworthy that their last feature on top M&A prospects in biopharma was in September 2019. So it may be worth paying attention to.

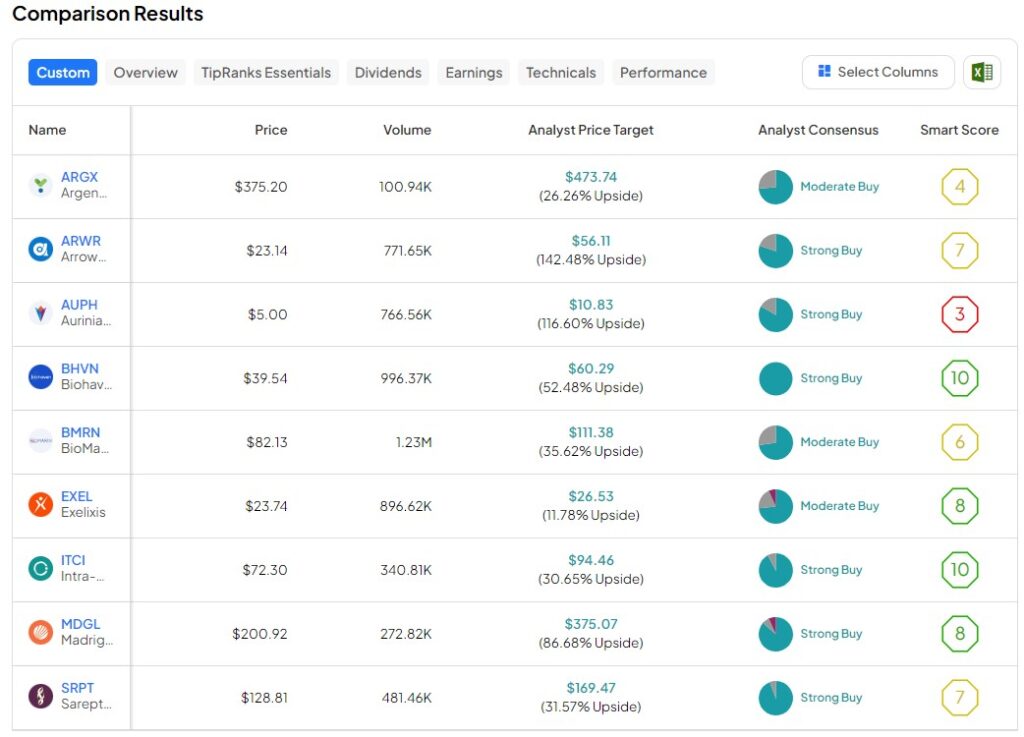

The industry magazine’s 2024 “picks” are Argenx (NASDAQ:ARGX), Arrowhead Pharmaceuticals (NASDAQ:ARWR), Aurinia Pharmaceuticals (NASDAQ:AUPH), Biohaven Pharmaceuticals (NYSE:BHVN), BioMarin Pharmaceutical (NASDAQ:BMRN), Exelixis (NASDAQ:EXEL), Intra-Cellular Therapies (NASDAQ:ITCI), Madrigal Pharmaceuticals (NASDAQ:MDGL), and Sarepta Therapeutics (NASDAQ:SRPT).

Taking this industry magazine’s “A-list” stocks and then using the TipRanks Comparison Tool to determine Wall Street analyst sentiment, we discover that Analyst Consensus shows that they are all listed as Buys. This breaks down to six, which are Strong Buys, and three that are Moderate Buys.

Key Takeaway

With a resurgent market fueled by M&A activity and continued innovation, biotech companies have the potential to deliver significant returns. Industry publications like Genetic Engineering & Biotech News can offer valuable insights into potential takeover targets, while the analytics of TipRanks can help further identify potential investments.