Multinational biotechnology company Biogen Inc. (NASDAQ: BIIB) has announced a commercialization and license agreement with Xbrane Biopharma AB. Xbrane develops biological drugs based on a patented platform technology.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Through the partnership, the companies will develop, manufacture, and commercialize Xcimzane, a preclinical monoclonal antibody, which is a proposed biosimilar referencing CIMZIA (certolizumab pegol).

CIMZIA is designed to treat rheumatoid arthritis in adults, as well as axial spondylarthrosis, psoriasis, and Crohn’s disease.

Terms of the Agreement

As per the terms of the commercialization agreement, Biogen will pay $8 million to Xbrane. Additionally, the company will pay around $80 million as milestone payments.

The deal provides Biogen exclusive global regulatory, manufacturing, and commercial rights to Xcimzane. After Xbrane completes the pre-clinical development of Xcimzane, Biogen will execute remaining development activities and incur the costs associated with gaining Marketing Authorization in all territories, including the costs of clinical development.

Official Comments

Head of Global Biosimilars at Biogen, Ian Henshaw, commented, “We aim to bring more biosimilars products to more patients and more geographies and we are excited to bring this additional asset to our Biosimilars pipeline. This preclinical biosimilar candidate has the potential to add another option for patients living with Rheumatoid Arthritis and other indications.”

Wall Street’s Take

Recently, Canaccord Genuity analyst Sumant Kulkarni maintained a Buy rating on Biogen but lowered the price target to $305 (37.82% upside potential) from $335.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 13 Buys and 15 Holds. The average Biogen price target of $264.78 implies 19.65% upside potential. Shares have lost 17.28% over the past year.

Bloggers Weigh In

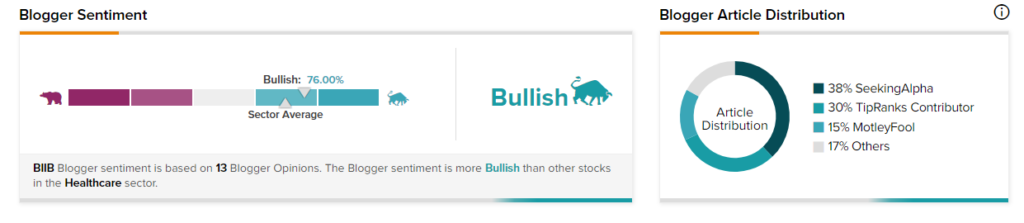

Bloggers seem enthused by the company’s balanced pipeline. TipRanks data shows that financial blogger opinions are 76% Bullish on BIIB, compared to a sector average of 70%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Merck Posts Upbeat Q4 Results, Earnings Guidance Disappoints

Apple to Unveil New Low-Cost 5G iPhone and iPad in March

Pioneer to Redeem Senior Notes Worth $1.25B