Shares of healthcare major Biogen (NASDAQ:BIIB) are on the rise today after the company posted better-than-anticipated second-quarter numbers. Revenue declined 5% year-over-year to $2.46 billion but landed past estimates by $100 million. EPS at $4.02 too comfortably outperformed expectations by $0.25.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, Biogen bagged two approvals in the U.S. for its Alzheimer’s and ALS therapies. Additionally, Spinraza data in spinal muscular atrophy remains promising. In Q2, while spinal muscular atrophy and biosimilar revenue remained largely flat, multiple sclerosis revenue declined by double digits.

Further, with a focus on new products, Biogen is also planning to lower its headcount by nearly 1,000. The company is aiming for $1 billion in savings under its ‘Fir for Growth’ program and plans to channel about 30% of these savings into clinical development programs and product launches.

Looking ahead, for full-year 2023, the company expects revenue to decrease in the mid-single digit percentage as compared to 2022. EPS for the year is seen landing between $15 and $16.

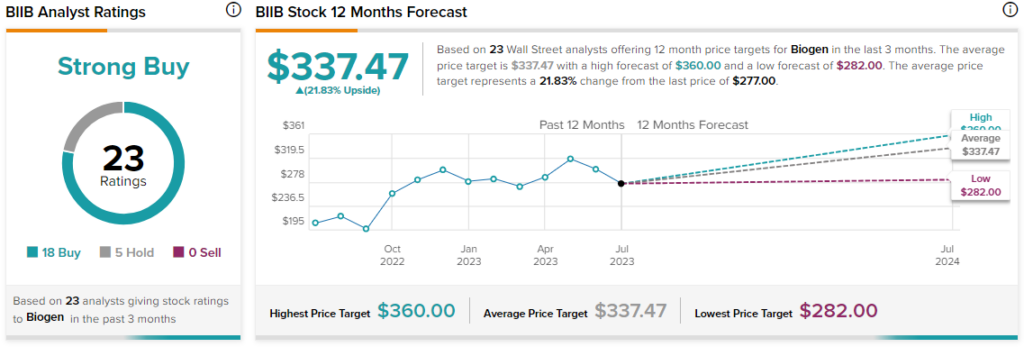

Overall, the Street has a $337.47 consensus price target on Biogen alongside a Strong Buy consensus rating. Shares of the company have surged nearly 33.5% over the past 52 weeks.

Read full Disclosure