BigBearai (BBAI) stock is rocketing higher today after the artificial intelligence (AI) and machine learning solutions company signed a contract with the U.S. Department of Defense’s (DoD) Chief Digital and Artificial Intelligence Office (CDAO). It will advance the company’s Virtual Anticipation Network (VANE) prototype to full use.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

BigBearai VANE prototype will be further developed as a tool for the DoD to track news from foreign countries. The goal is to allow the DoD to better track news from countries that could be adversaries of the U.S. With that, the agency could more efficiently evaluate potential threats to the U.S.

BigBearai President of National Security Ryan Legge said the contract will “support in the modernization of our nation’s defense efforts.” He claims VANE equips “warfighters with sophisticated intelligence capabilities to leverage foreign insights critical to the safety of our Nation and those protecting it.”

How This Affects BBAI Stock Today

Investors are excited about BigBearai signing a contract with the DoD. As a result, shares of BBAI stock are up 49.49% as of this writing. That builds on its 60.9% increase year-to-date and its massive 311.49% rally over the past 52 weeks.

The increased interest in BBAI stock comes with heavy trading of the company’s shares. This has more than 135 million units changing hands today, roughly triple BigBearai’s three-month daily average trading volume of 46.43 million shares.

Is BBAI Stock a Buy, Sell, or Hold?

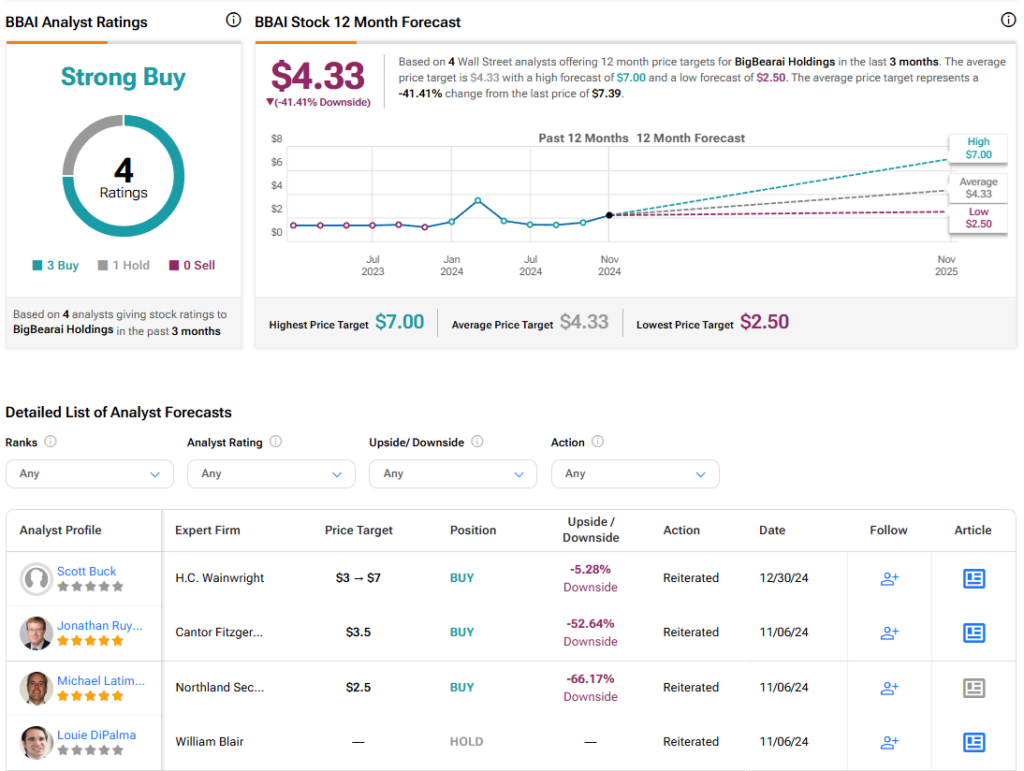

Turning to Wall Street, the analysts’ consensus rating for BigBearai is Strong Buy based on three Buy and one Hold ratings over the last three months. With that comes an average price target of $4.33, a high of $7, and a low of $2.50. This represents a potential 41.41% downside for BBAI stock.