BigBear.ai Holdings (BBAI) is riding the artificial intelligence (AI) wave, with its shares jumping over 88% in the past month as investor sentiment has turned bullish on all things AI once again. The company’s focus on defense and national security gives it a competitive advantage, and a strong contract pipeline and improved financial position provide reasons for optimism.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, the company is still struggling to achieve consistent profits. BBAI’s persistent losses and premium valuation make me Neutral on the stock, preferring to monitor progress toward profitability and more evident signs of sustainable growth.

BBAI’s Defense-Focused AI Specialist Narrative

BigBear.ai focuses primarily on providing specialized AI solutions for government and defense applications. The company’s bread and butter comes from serving U.S. defense and intelligence agencies, border protection services, and transportation security organizations. Its technology handles everything from data processing and machine learning to predictive analytics and biometric identification systems.

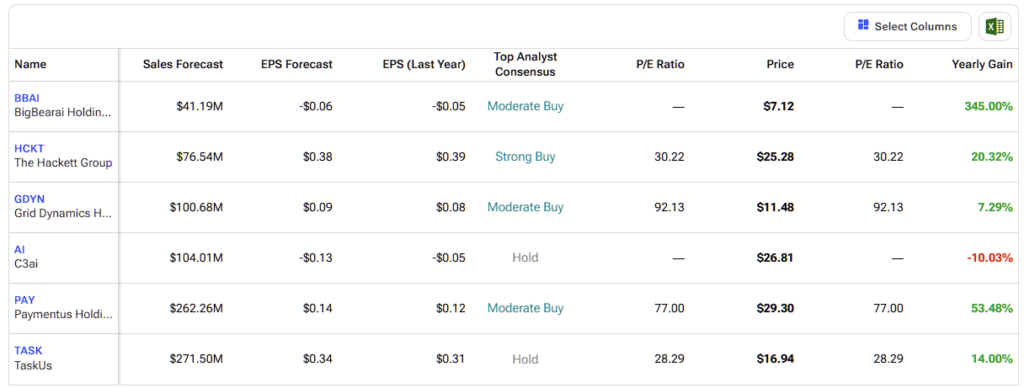

What sets BigBear.ai apart from tech giants like IBM (IBM) or emerging competitors like C3.ai (AI) is its deep expertise in mission-critical, high-security environments. Building AI systems for the Department of Defense requires a different level of security clearance, reliability, and specialized knowledge than creating consumer applications. This creates significant barriers to entry and positions the company to compete against much larger rivals.

Recent wins underscore this competitive positioning. The company has secured new partnerships in the United Arab Emirates and landed contracts for U.S. Army drone swarm operations. It has also expanded its biometric and digital identity solutions to major airports both domestically and internationally.

Financial Growing Pains Persist for BBAI

BigBear.ai’s first quarter of FY2025 results showed modest progress, with ongoing profitability challenges. Revenue grew 5% year-over-year to $34.8 million, driven primarily by new contracts with the Department of Homeland Security and expanded digital identity projects. While growth is moving in the right direction, the pace remains relatively modest.

Net losses narrowed dramatically from $127.8 million in Q1 2024 to $62.0 million in Q1 2025. However, this improvement came primarily from avoiding the massive goodwill impairment charges that hurt results the previous year, rather than from operational improvements.

Further, adjusted EBITDA worsened, moving from a loss of $1.6 million to a loss of $7 million. This deterioration reflects increased spending on research and development, higher administrative costs from recent acquisitions like Pangiam, and the impact of delayed government funding that left the company with excess capacity.

The balance sheet tells a much brighter story. Cash reserves surged to $107.6 million from $50.1 million, while long-term debt decreased significantly. This improvement reduced the company’s net debt position from $150 million to just $27 million, providing much-needed financial flexibility for the growing company.

Finally, the company reported a robust backlog of $385 million in future contracts. This provides significant revenue visibility and validates the market demand for their specialized services. Still, management reaffirmed their 2025 guidance for revenue between $160-180 million with negative single-digit Adjusted EBITDA margins.

A Big Bear That’s Priced for Perfection

BigBear.ai trades like a growth stock despite its profitability challenges. The recent stock surge appears driven more by retail investor enthusiasm and sector momentum than by fundamental analyst upgrades or earnings beats. With a market capitalization of ~$2 billion, the company commands a price-to-sales ratio of 11.52x and a price-to-book ratio of 10.77x. These multiples sit well above industry medians of 3.3x and 3.68x, respectively.

The current valuation represents a significant leap of faith, given the company’s track record of losses and modest revenue growth. The improved balance sheet provides time and financial runway, but investors are essentially pricing the stock for future perfection, rather than current performance.

Is BigBear.ai a Good Stock to Buy?

Analysts following the company have voiced optimism for the stock, tempered by company-specific execution concerns. The company is rated a Moderate Buy overall, with two Buy and three Hold recommendations. The average price target for BBAI stock is $5.38, which represents a potential downside of 24% from current levels.

H.C. Wainwright analyst Scott Buck recently reiterated a Buy rating with a $9 price target, citing the company’s strong first-half 2025 performance. Buck points to new customer acquisitions, contract momentum, and favorable trends in AI-driven defense and security markets as key growth drivers. He expects revenue acceleration to continue into 2026 and sees significant upside potential relative to industry peers.

In contrast, William Blair’s Louie DiPalma has reiterated a Hold rating, reflecting a more cautious stance following mixed first-quarter results. While the company secured significant contracts, Q1 revenue came in slightly below expectations, and adjusted EBITDA significantly underperformed consensus estimates. Despite improvements in cash position and debt reduction, DiPalma warns that current financial metrics warrant taking a measured approach.

The Bottom Line on BBAI

BigBear.ai’s specialized expertise in defense and security applications, strong government relationships, and improved financial flexibility are compelling. However, persistent unprofitability, unproven execution in commercial markets, and a premium valuation create meaningful downside risk. The stock’s recent surge has priced in significant future success, leaving little room for disappointment.

At this point, waiting for either valuation compression or more unmistakable evidence of sustainable growth and margin expansion seems prudent.