Shares of BigBear.ai (BBAI) rallied 8.2% on Friday, January 2, kicking off 2026 on a high note after a 23% drop in December. Despite the volatility, BBAI gained 30% overall in 2025. The key question is whether this rally persists, or will AI bubble fears and company headwinds pull BBAI shares down?

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

BigBear.ai builds AI-powered decision intelligence solutions that convert vast data into real-time insights for complex scenarios. It targets mission-critical operations in defense, national security, and critical infrastructure.

Why Did BBAI Stock Gain 8.2%?

On Friday, BigBear.ai announced that it is actively working to reduce its debt burden and “significantly improve” its balance sheet, one of the key investor concerns. BBAI is redeeming all of its 6% Convertible Senior Secured Notes due 2029. This will eliminate about $125 million in debt, reducing it to about $17 million, by January 16, 2026, through conversions and cash redemption. The company noted that about $58 million in principal was voluntarily converted during 2025.

Importantly, BBAI expects to complete the conversion without any material cash outlay and will issue shares of its common stock that were reserved for this purpose. Although the share issuance will increase BigBear.ai’s public float, it will eliminate the related debt and interest obligations from its balance sheet.

CEO Kevin McAleenan stated, “By meaningfully reducing our debt burden, we will improve our financial flexibility and position the company to pursue our next chapter of growth, balancing targeted acquisitions with continued organic expansion.”

What’s Next for BigBear.ai Stock?

BBAI grapples with declining revenues, ongoing losses, and fierce competition from Palantir Technologies (PLTR) and C3.ai (AI) in the defense AI market, who offer faster deployments and deeper government ties. Nonetheless, BBAI seems determined to move past these issues with strategic steps like bolstering its liquidity.

Moreover, BBAI completed its $250 million acquisition of Ask Sage, bolstering its capabilities in mission-critical environments. Ask Sage is a fast-growing generative AI platform tailored for secure deployment, orchestration, and agentic features in defense, intelligence, and regulated sectors.

Ask Sage is expected to generate $25 million in annual recurring revenue (ARR) in 2025, a sixfold jump from 2024. It currently serves over 16,000 government teams and its platform adoption is rapidly rising due to compatibility with popular AI models from Anthropic, OpenAI, Amazon (AMZN) Web Services, Google (GOOGL), and other open-source AI technologies.

Furthermore, BBAI entered a key partnership with C Speed to integrate its AI technologies with advanced radar systems, enabling superior threat detection for homeland security and defense applications.

Plus, BigBear.ai opened an office in Abu Dhabi, marking its initial expansion beyond U.S. government markets. This strategic move targets rising Middle East demand for AI-driven security solutions amid projected national security spending growth in 2026-2027.

Is BBAI Stock a Good Buy?

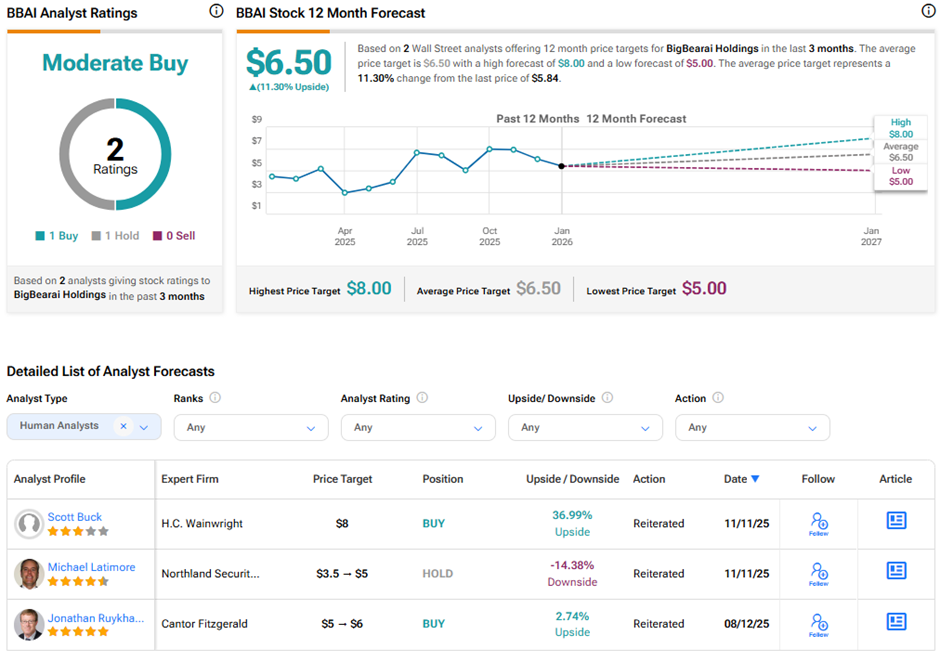

Analysts remain divided about BigBear.ai’s long-term prospects. On TipRanks, BBAI stock has a Moderate Buy consensus rating based on one Buy and one Hold rating. The average BigBear.ai price target of $6.50 implies 11.3% upside potential from current levels.