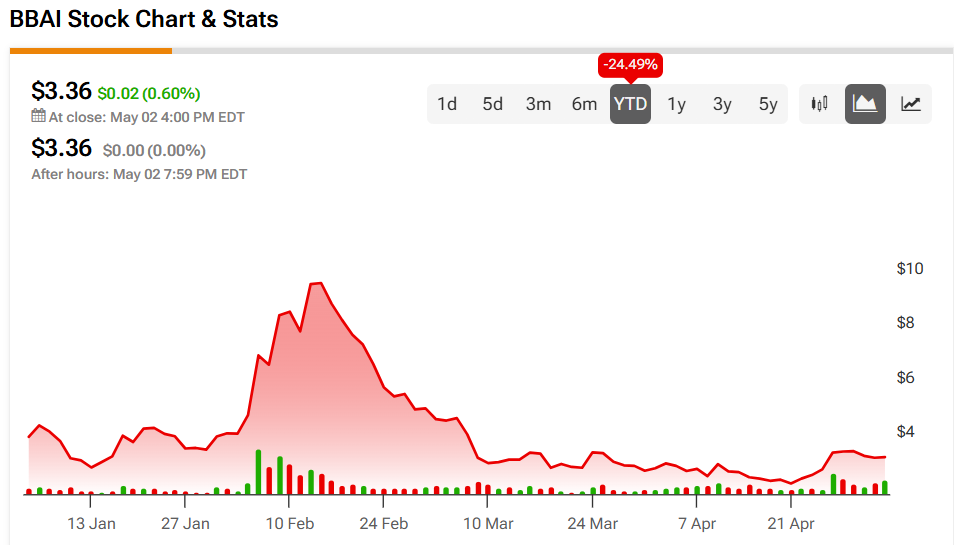

BigBear.ai Holdings (BBAI) just got a fresh dose of optimism. The tech-driven company, which specializes in AI and analytics and provides solutions that help organizations make informed, data-driven decisions, just got a nice boost from two well-known Wall Street firms: H.C. Wainwright and Cantor Fitzgerald. Both institutions reiterated their Buy ratings this week, signaling renewed confidence in the company’s growth potential and financial footing. This, of course, came after the company released its Q1 earnings on May 1, which showcased improved revenue and cash flow but also saw a notable increase in net loss and higher non-cash losses.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

A Clear Vote of Confidence

Scott Buck from H.C. Wainwright maintained a $6 price target, highlighting BigBear.ai’s strengthening balance sheet, expanding backlog, defense and border security opportunities. According to Buck, despite recent losses, the company reaffirmed its 2025 revenue guidance, and strategic positioning supports a bullish outlook.

Yi Fu Lee, a four-star analyst from Cantor Fitzgerald, echoed the upbeat tone but trimmed his price target from $6 to $5, citing slightly tempered expectations. Still, he highlighted BigBear.ai’s strong financial position and potential for long-term growth.

Together, these Buy calls contrast with the more neutral takes from Northland Securities and William Blair, who both reiterated Hold ratings. Northland even lowered its target from $4 to $3.5, signaling caution over near-term performance.

Is BigBear.ai a Good Stock to Buy?

While the analyst consensus remains a Moderate Buy, these two Buy ratings may have reinvigorated sentiment around the stock. The average price target for BBAI stock is $4.83, suggesting a 43.75% upside potential from current levels.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue