Baidu (NASDAQ:BIDU) announced strong first-quarter results on Thursday. The Chinese tech giant generated revenues of RMB31.5 billion ($4.4 billion) in the first quarter, up by 1% year-over-year. The revenues exceeded consensus estimates of $4.34 billion.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The company reported adjusted earnings of RMB19.91 ($2.76) per American Depository Share (ADS), marking a 24% year-over-year increase and beating analyst estimates of $2.21 per share.

Baidu’s Key Performance Highlights in Q1

Baidu’s revenues in the first quarter were driven by stable online marketing revenues and higher revenue from its AI Cloud business. The company is increasingly focusing on ramping up the sales of its AI products even as it derives a majority of its revenues from advertising.

Baidu Core business, which includes its cloud offerings, search-based ad sales, and autonomous driving initiatives saw revenues of RMB23.8 billion ($3.30 billion), up by 4% year-over-year. This business saw online marketing revenue of RMB17.0 billion ($2.36 billion) in Q1, an increase of 3% year-over-year. On the other hand, Baidu Core’s non-online marketing revenue was RMB6.8 billion ($935 million), a jump of 6% year-over-year, mainly driven by its AI Cloud business.

What Is the Future of BIDU Stock?

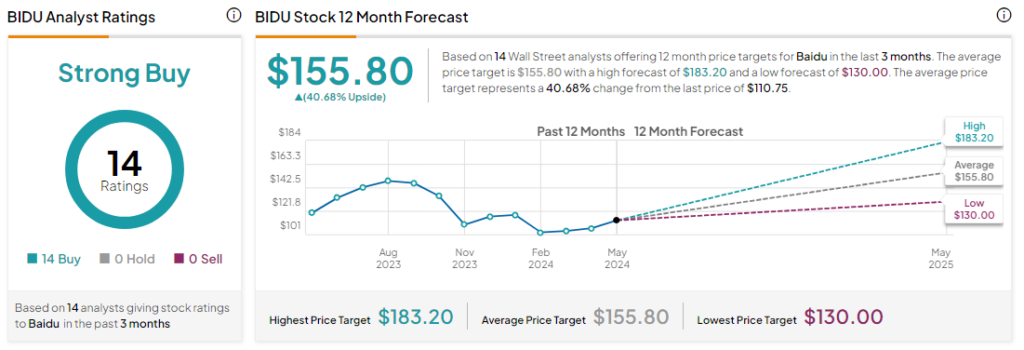

Analysts remain bullish about BIDU stock, with a Strong Buy consensus rating based on a unanimous 14 Buys. Over the past year, BIDU has declined by more than 15%, and the average BIDU price target of $155.80 implies an upside potential of 40.7% from current levels. These analyst ratings are likely to change following BIDU’s Q1 results.