Plant-based meat maker Beyond Meat (BYND) is scheduled to announce its results for the third quarter of Fiscal 2025 (ended September 27, 2025) on Monday, November 10, 2025, one day earlier than the previously announced date. The company made the adjustment due to the Veterans Day holiday, during which the U.S. Securities and Exchange Commission (SEC) will be closed. Previously, BYND delayed its Q3 earnings release to November 11 from November 4 to finalize a notable impairment charge related to certain long-lived assets.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

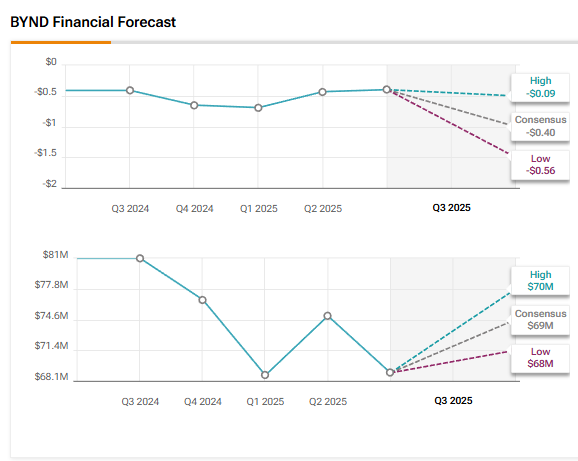

Wall Street expects Beyond Meat to report a Q3 loss per share of $0.40, slightly lower than last year’s loss of $0.41 per share. Meanwhile, revenue is expected to decline 16% year over year to $68.98 million. Beyond Meat has been struggling with lackluster sales due to weak demand for its plant-based meat offerings amid a shift towards healthier foods, elevated inflation, and the rise of weight-loss drugs.

Key Updates Ahead of Earnings

Earlier this month, BYND stock witnessed a spike that was not related to its fundamentals but was sparked by a meme-stock frenzy. The stock remains volatile and is down 63% year-to-date.

Meanwhile, in Friday’s regular trading, Beyond Meat stock jumped 16.8% as U.S. President Donald Trump directed the Department of Justice (DOJ) to investigate major meat companies for alleged price manipulation, with beef prices touching record highs.

However, the stock fell 6.5% in the extended trading session. Meanwhile, BYND announced a delay in filing its Form 10-Q for Q3 FY25 and disclosed a material weakness in its internal controls over financial reporting, particularly related to the accounting for non-recurring and complex transactions.

Mizuho’s Views Ahead of Beyond Meat’s Q3 Earnings

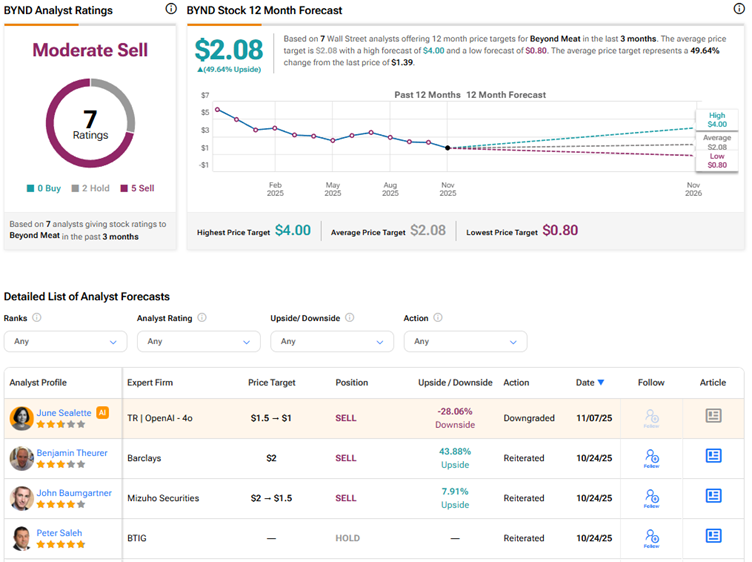

Heading into Q3 earnings, Mizuho analyst John Baumgartner reiterated a Sell rating on Beyond Meat stock with a price target of $1.50. Reacting to BYND’s preliminary update, the analyst noted that the company’s Q3 net revenue estimate of about $70 million indicates a 14% year-over-year decline, comparable with the Street’s expectations and the midpoint of the guidance. However, Baumgartner noted that BYND’s EBIT (earnings before interest and taxes) estimate was below Wall Street’s consensus, with expectations of a softer gross margin.

Baumgartner expects BYND’s fundamentals to continue to be under pressure due to a favorable trend in animal meat consumption, with demand being resilient despite record prices. The analyst contended that while the company’s cost savings are expected to support EBITDA (earnings before interest, taxes, depreciation, and amortization), he expects persistent free cash flow burn due to continued weakness in the top line.

Baumgartner also believes that the disclosure of an unquantified but “material” impairment charge reflects BYND’s lackluster expectations for the years ahead, reinforcing Mizuho’s lowered estimates ($2.4 billion from the prior forecast of $4 billion) for U.S. plant-based meat category sales over the next 10 years. The analyst is bearish on BYND stock but prefers SunOpta (STKL) for exposure to the plant-based food and beverage space. Baumgartner has a Buy rating on STKL stock with a price target of $10.

AI Analyst Is Bearish on BYND Stock Ahead of Q3 Print

Interestingly, TipRanks’ AI Analyst has assigned an Underperform rating to BYND stock with a price target of $1, indicating 28.1% downside risk. The AI Analyst’s rating is based on Beyond Meat’s dismal financial performance, with declining revenues, high costs, and massive losses. Moreover, technical analysis indicates a bearish outlook, with BYND stock trading below key moving averages and weak momentum indicators.

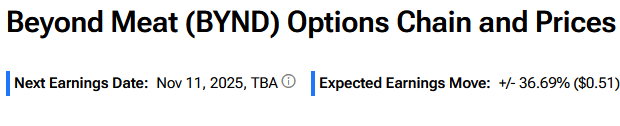

Options Traders Anticipate a Major Move on BYND’s Q3 Earnings

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about a 36.7% move in either direction in BYND stock in reaction to Q3 FY25 results.

Is BYND a Good Stock to Buy?

Currently, Wall Street has a Moderate Sell consensus rating on Beyond Meat stock based on two Holds and five Sell recommendations. The average BYND stock price target of $2.08 indicates about 50% upside potential from current levels.