For investors involved in the EV sector, the big question revolves around the extent of current growth opportunities.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

In 2024, market researcher IHS Automotive is forecasting that global EV shipments will grow 33% year-over-year. Yet, Mizuho’s Vijay Rakesh, a 5-star analyst rated in the top 1% of the Street’s stock pros, believes it’s way too optimistic.

Inventories of electric vehicles on dealer lots, warns the analyst, are twice as high as inventories of conventional internal combustion engine vehicles. Prices are still too high to attract a lot of buyers – indeed, average car prices are up 30% over the past three years. At the same time, governments in the U.S., EU, and China are all pulling back on subsidies that might have offset the price spikes and encouraged more buying.

Taken all together, Rakesh believes this will restrain EV sales growth this year to just 15% – less than half of what IHS is projecting (and what investors may be counting on). And even 2025 won’t be much better, with Rakesh forecasting sales growth of just 17% next year.

Now, to combat these trends and encourage more buying, car companies are cutting EV prices, especially in China. Long term, that’s a policy that may bear fruit – but it won’t do anything good for profit margins, with out government subsidies to replace the lost revenue.

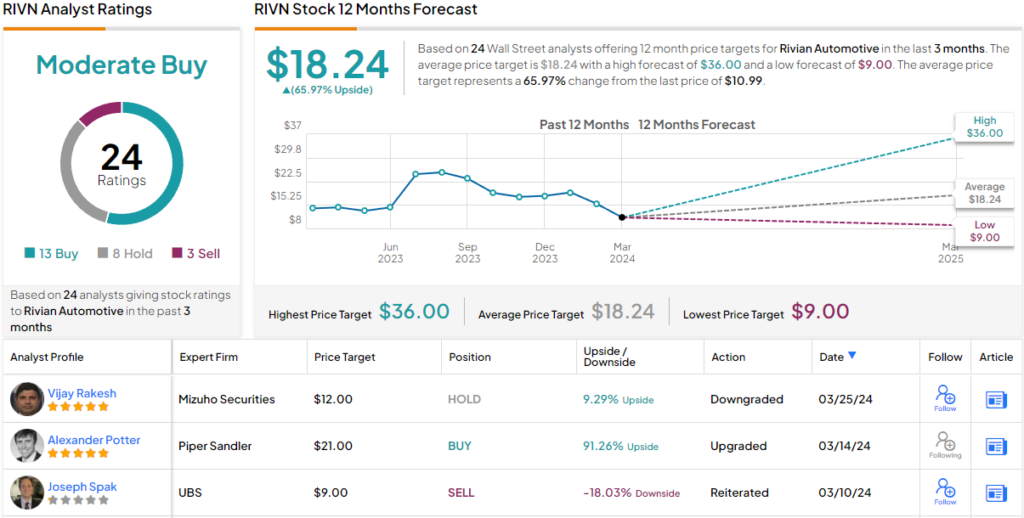

This, in a nutshell, is why Rakesh is turning more conservative on Rivian (NASDAQ:RIVN) stock – downgrading it to Neutral, while giving it a $12 price target. (To watch Rakesh’s track record, click here)

As has already been well-publicized, Rivian is itself a prime contributor to slower-than-expected sales in the EV industry. Last month, the company forecast that 2024 EV sales will be flat year over year at 57,000 units – so Rivian will be contributing exactly zero growth to overall EV sales this year. Next year should be better, with Rivian growing sales to 74,500 units – 30% growth. Unfortunately, most analysts on Wall Street are still expecting to see Rivian sell 83,000 units next year, so Rakesh is in effect predicting a deliveries miss.

Longer term, it’s true that Rivian may have a hit on its hands with the recently announced R2 electric SUV, priced significantly below its current R1T and R1S models. But the R2 isn’t expected to be ready for production before 2026 – meaning Rivian first needs to survive 2024 and 2025 to see any benefit from it. The good news is that, with $9.4 billion in cash and a burn rate (that Rakesh estimates) at $1 billion per quarter, Rivian stands a good chance of making it to 2026.

The bad news is that, seeing as Rivian burned closer to $1.5 billion in cash, quarterly, over each of the last two years, even Rakesh’s more conservative take on the company… may prove to be still overoptimistic.

Overall, the rest of the Street leans cautiously to the bullish side. RIVN’s Moderate Buy consensus rating is based on 13 Buy recommendations, 8 holds and 3 Sells. There’s possible upside of ~66%, should the target of $18.24 be met in the year ahead. (See RIVN stock forecast)

To find good ideas for EV stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue