As the global race to dominate autonomous technology accelerates, Morgan Stanley has spotlighted Tesla (TSLA) as the front-runner poised to lead the charge. In a recent report, the investment bank highlighted China’s significant advantage in the field of “embodied AI,” including autonomous vehicles, drones, and humanoid robots. Despite this lead, Morgan Stanley believes Tesla is “best positioned” to drive the U.S.’s efforts in closing the gap.

US Races to Catch Up in Autonomous Tech War

Recently, the Trump administration introduced significant regulatory changes, including more flexibility in testing and launching self-driving cars. This move aims to bolster U.S. competitiveness in the ongoing race with China for dominance in autonomous vehicle technology.

The new rules, announced by the U.S. Department of Transportation and the National Highway Traffic Safety Administration (NHTSA), will let companies working on self-driving cars request exemptions from some federal safety regulations.

“If Tesla doesn’t help narrow the gap, who will?”

Morgan Stanley analysts, led by four-star-rated Adam Jonas, pointed out that China produces more drones in a single day than the U.S. does in an entire year, pointing to AI’s transformative impact on manufacturing efficiency. The analysts added that although the U.S. government is starting to acknowledge the urgency, there are still significant policy gaps to address.

However, Jonas and his team believe that “If Tesla doesn’t help narrow the gap, who will?”

The investment bank further highlighted Tesla’s competitive advantage through six key pillars: data, robotics, energy, AI, manufacturing, and space. Notably, Tesla currently has 7 million cars on the road and is on track to exceed 100 million by 2035. The company also leads in robotics and battery technology. Analysts further emphasized that Tesla’s vehicles go beyond being mere products. They function as dynamic platforms for advancing and fine-tuning AI systems with broad and transformative potential.

In light of this, Jonas believes Tesla’s upcoming launch of unsupervised autonomous vehicles in Austin by the end of June could mark a significant milestone. Unlike California, Texas regulations seem more favorable for such deployments, potentially easing the path for this major development.

What Is the Prediction for Tesla Stock?

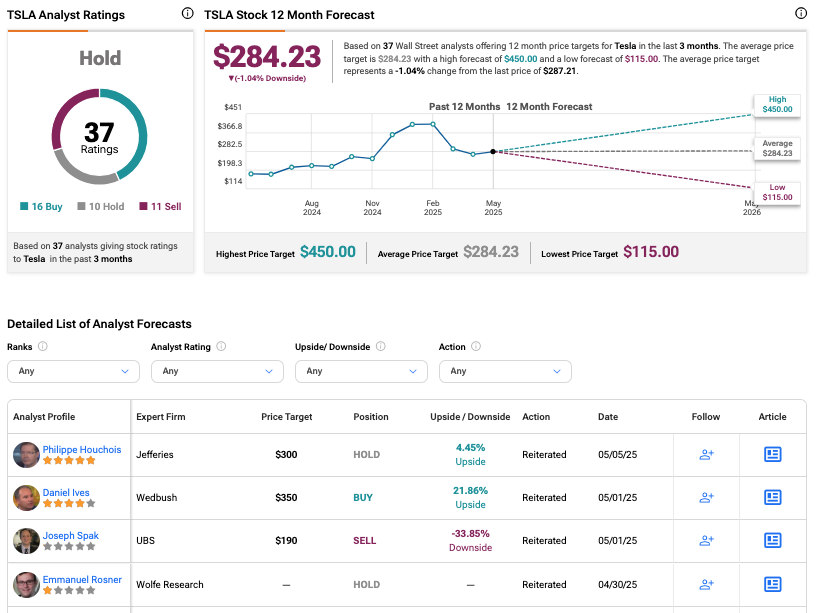

According to TipRanks, TSLA stock has received a Hold consensus rating, with 16 Buys, 10 Holds, and 11 Sells assigned in the last three months. The average Tesla stock price target is $284.23, suggesting a potential downside of 1.04% from the current level.