Bernstein analyst Lance Wilkes raised his price target for UnitedHealth Group (UNH) stock to $440 from $433 and reiterated a Buy rating. The analyst believes that UNH stock’s valuation is attractive given his expectation of “outsized” recovery in the earnings per share (EPS) growth over the next four years. Wilkes and several other Wall Street analysts have raised their price targets for UNH stock after the health insurer delivered better-than-expected third-quarter results, reflecting progress on its turnaround strategy amid high medical costs and other challenges.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Bernstein Analyst Is Bullish on UnitedHealth’s Growth Prospects

Wilkes updated his EPS model for UnitedHealth following the company’s better-than-expected Q3 earnings. The analyst expects a sector-wide turnaround as Medicare Advantage (MA) and Medicaid businesses recover from trough margins following MA rate shocks, withdrawal of competition, and redeterminations.

The analyst sees evidence of pricing discipline being restored in UnitedHealth’s MA and Optum Health businesses, which he believes will “shock” growth in the short term but restore margins more swiftly.

Over the medium term, Wilkes sees a recovery in earnings, as UNH restores pricing discipline, driving margin recoveries in the MA and Optum Health businesses. Longer term, the analyst prefers having exposure to the leading value-based care (VBC) player, as he expects VBC to become more important across all product lines, given the very high medical cost trend levels. Further, he believes that Optum Insight, UNH’s data and analytics division, is well-positioned to become a player selling artificial intelligence (AI) solutions for care delivery efficiencies to providers and hospitals.

Is UNH a Good Stock to Buy?

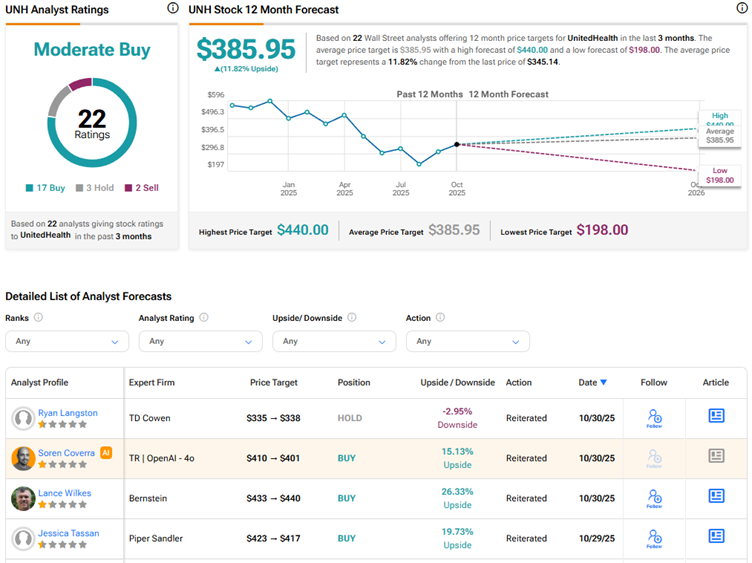

Currently, Wall Street has a Moderate Buy consensus rating on UnitedHealth stock based on 17 Buys, three Holds, and two Sell recommendations. The average UNH stock price target of $385.95 indicates 12% upside potential.