At Berkshire Hathaway’s (BRK.A) (BRK.B) annual shareholder meeting, investors rejected seven proposals on diversity, equity, and inclusion (DEI), AI risks, and environmental reports. The meeting also brought unexpected news of Warren Buffett planning to step down as CEO at the end of 2025. He will ask the Board to appoint Vice Chairman Greg Abel as the next CEO, marking a major leadership transition for the conglomerate.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Key Proposals Rejected

One of the key proposals that failed to pass required Berkshire to report on risks tied to race-based programs at its subsidiaries. Another proposal called for a report on how the company’s business impacts employees based on race, religion, sex, national origin, and political views.

Other proposals included setting up a board group for diversity oversight, assigning directors to check AI risks, and reporting extra environmental efforts beyond legal requirements.

It is worth noting that Buffett, who holds 30% of Berkshire’s voting power, and the other directors recommended voting against all seven proposals. He argued they were unnecessary and did not fit the company’s independent style. Further, the board said that each subsidiary makes its own rules, and Berkshire’s main approach is to “follow the law and do the right thing”.

Broader Trend in Corporate America

Many firms have pulled back on diversity programs as political and legal pressures grow. This trend picked up speed during President Trump’s second term, with conservative groups pushing back on DEI efforts in business and government.

Interestingly, Berkshire’s latest annual report removed references to diversity and inclusion as a hiring goal, pointing to a change in its approach to workforce policies.

Major companies like Ford (F), McDonald’s (MCD), Walmart (WMT), and tech giants like Meta (META), Amazon (AMZN), and Google (GOOGL) have also cut back on these initiatives.

Is BRK.B Stock a Buy, Sell, or Hold?

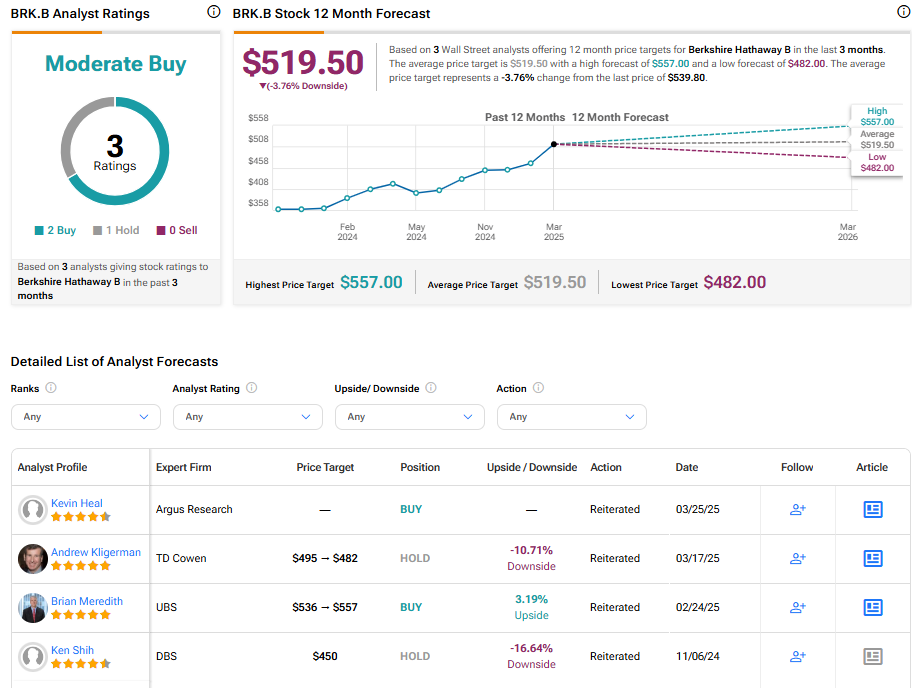

Turning to Wall Street, BRK.B stock has a Moderate Buy consensus rating based on two Buys and one Hold assigned in the last three months. At $519.50, the average Berkshire Hathaway stock price target implies 3.76% downside potential.