Berkshire Hathaway (BRK.B) stock has formed a bullish “golden cross” pattern just as longtime CEO Warren Buffett prepares to retire from the company at year’s end.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

A golden cross emerges when a stock’s 50-day moving average, a data point used as a short-term trend tracker, crosses above the 200-day moving average, which is seen as a dividing line between long-term uptrends and downtrends. Chart analysts say a golden cross typically signals upside for a stock.

In Berkshire Hathaway’s case, this is the first time in nearly three years that its stock has formed a golden cross, suggesting that the company’s share price could rally into the end of 2025 and beyond. Some analysts are saying that Berkshire’s stock looks to be headed for a long-term uptrend.

Buffett’s Exit

The golden cross has formed about 10 weeks before Warren Buffett, arguably the most successful investor in history, is slated to step down as Berkshire’s CEO after leading the holding company for 60 years. However, Buffett will remain on Berkshire’s board of directors.

Over the past 25 years, Berkshire Hathaway’s stock has experienced a total of 13 golden crosses. The average gain after each previous golden cross was 33.5%. So far this year, Berkshire Hathaway’s more affordable class B stock has gained 9%, underperforming the benchmark S&P 500’s 14% year-to-date gain. Berkshire’s stock fell on news of Buffett’s retirement this past spring.

Is BRK.B Stock a Buy?

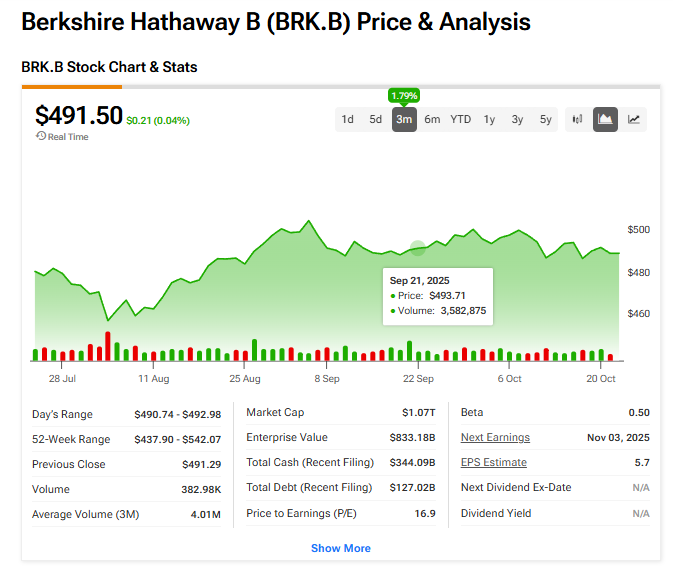

Only a few analysts currently offer a rating and price target on Berkshire Hathaway’s more affordable class B stock. So instead, we’ll look at the stock’s three-month performance. As one can see in the chart below, shares of BRK.B have risen 1.79% in the last 12 weeks.