Berkshire Hathaway (BRK.B) stock was steady this weekend following the release of its first-quarter 2025 earnings report. While the headline numbers showed a steep decline in profits, Warren Buffett’s company remains confident in its long-term strategy, and investors appear to agree.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The report showed net earnings of $4.6 billion, down sharply from $12.7 billion in the same quarter a year ago. That 64% drop was primarily driven by $5 billion in investment losses, as Berkshire’s stock portfolio suffered from market volatility.

Operating earnings, which Buffett says are a better measure of the business, fell to $9.6 billion, a 14% drop from last year’s $11.2 billion. That translates to $4.47 per Class B share, missing the Wall Street average estimate of $4.72.

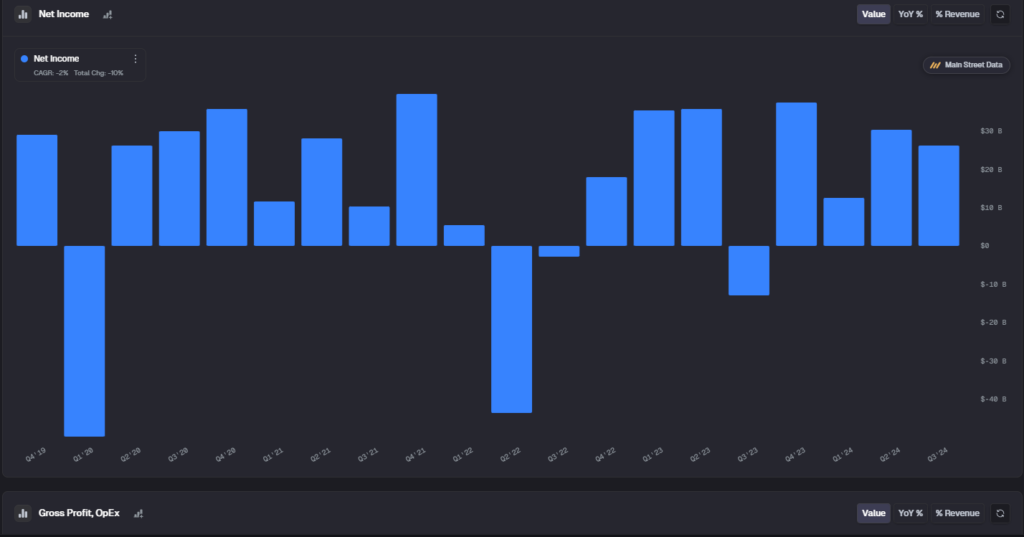

The following chart by Main Street Data (MSD) shows Berkshire Hathaway’s net income swinging sharply from quarter to quarter, reflecting how market-driven investment gains and losses significantly impact its bottom line. Despite occasional strong earnings, the overall trend since 2019 is slightly negative, with a 10% total decline and a -2% compound annual growth rate.

Revenues Flat, Insurance Takes a Hit

Revenue for the quarter was $89.7 billion, slightly below expectations and nearly flat compared to Q1 2024. The company’s biggest pain point was its insurance underwriting business, where profits dropped nearly 49%. Berkshire cited wildfire-related losses in California totaling $1.1 billion as a major factor.

Not all was gloomy, though. Berkshire Hathaway Energy posted a 52% jump in earnings, thanks to strong performance in regulated utilities. Meanwhile, BNSF Railway held steady, and the conglomerate’s manufacturing and retail segments saw only modest declines.

Berkshire also reported a $713 million loss from foreign currency swings, as the U.S. dollar weakened against key currencies like the Japanese yen.

Cash Keeps Growing, But No Big Moves Yet

Despite the earnings drop, Berkshire’s cash pile grew by $13 billion year-over-year to reach a record $347.7 billion. However, Buffett didn’t deploy much of it — Berkshire was a net seller of stocks for the 10th straight quarter and did not repurchase any shares in Q1.

This cautious stance may reflect Buffett’s view that current stock valuations are still too high for major investments. But with that much dry powder, investors continue to hope for a blockbuster deal.

What’s Next for Berkshire Hathaway?

The earnings release coincided with Berkshire’s famous annual shareholder meeting in Omaha, often dubbed “Woodstock for Capitalists.” There, Buffett addressed a packed crowd, offering his take on the current economic climate, tariffs, and the insurance market.

In the report, the company warned of ongoing “considerable uncertainty” from tariffs and trade risks, particularly those reintroduced by former President Trump. That, combined with unpredictable insurance losses, could weigh on profits in the coming quarters.

Still, Buffett told shareholders that operating earnings remain the focus, and short-term market swings won’t distract Berkshire from its long-term game plan.

Is BRK.B Stock a Buy, Sell, or Hold?

According to Wall Street analysts, Berkshire Hathaway is considered a Moderate Buy. The average price target for BRK.B stock is $519.50. This reflects a 3.76% downside potential.