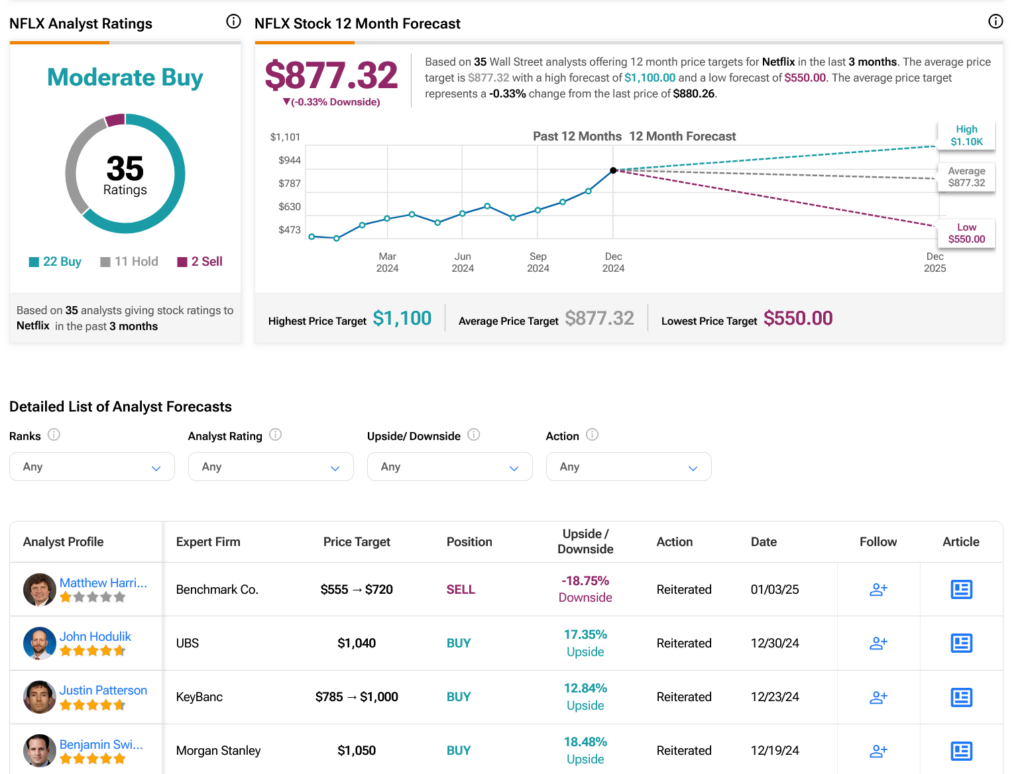

It was, somewhat, bad news for streaming giant Netflix (NFLX) as Benchmark analysts are reconsidering Netflix’s current valuation. The levels are just a bit too high for Benchmark right now, and as such, Benchmark is leaving the rating alone. That gave investors pause, and shares dipped fractionally in the closing minutes of Friday’s trading.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Benchmark analysts left the Sell rating on Netflix stock, noted reports. Despite this, they hiked the price target substantially, going from $555 per share to $720 per share. Even as the analysts hiked the price target, they warned investors that the current pricing may not be sufficiently supported.

To be sure, Netflix had quite a bit going for it, noted the reports. Some really high-end programming is helping things out, along with the recent gains thanks to the ad-supported tier. But a lot of those gains have already been priced in, Benchmark believes. So in order for Netflix to make future gains, it needs new initiatives. All Netflix really has on that front are pricing strategies and bringing ad-support to its video on demand (VOD) operations.

The Content is Holding Up

However, there are some things in the works that should at least keep some users in the fold. For instance, there are signs that the One Tree Hill revival could be getting closer to a real thing. It has not been formally greenlit, noted AV Club, but word from Hilarie Burton—both star and executive producer—suggests that there is at least some interest. And recent leaks have helped fire some of that interest, which in turn might at least nudge Netflix’s hand, if not force it outright.

Finally, there are some projections about just how much impact Netflix will have on WWE viewership, when WWE Raw makes its appearance on Netflix in a matter of days. Word from Dave Meltzer in Wrestling Observer Newsletter says that the younger demographic is likely to increase its viewership as a result, as evidenced by Netflix’s success with the Christmas Day football games.

Is Netflix Stock a Good Buy Right Now?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 22 Buys, 11 Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 86.68% rally in its share price over the past year, the average NFLX price target of $877.32 per share implies 0.33% downside risk.