Shares of the UK-based Bellway PLC (GB:BWY) jumped nearly 7% as of writing after the company upgraded its outlook for FY25, as borrowing costs declined. The company aims to complete at least 8,500 homes in FY25, up from 7,654 homes in the previous year. Additionally, it is targeting an average selling price of £310,000, up from £307,909 in 2024, and an underlying operating margin of 11.0%, marking an improvement from 10.0%.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Bellway is a British property developer that specializes in residential properties.

Bellway Expects Growth Ahead Despite Profit Decline

Bellway expects growth ahead despite reporting a 57.5% year-over-year decline in its pre-tax profits for FY24. Revenue dropped to £2.38 billion from £3.41 billion last year, with home completions falling to 7,654 units from 10,945.

Nonetheless, Bellway remains optimistic for 2025, as it noted a gradual improvement in buyer sentiment, driven by the interest rate cut in August, the new Labour government’s supportive housing policies, lower inflation, and rising wages. Moreover, its forward order book stands at £1.43 billion, surpassing last year’s £1.23 billion.

On the other hand, the company proposed a total dividend of 54.0p per share, down from 140p in the previous fiscal year. This reflected the decreased underlying earnings.

Analysts Weigh in on Bellway’s Numbers

Analyst Aynsley Lammin from Investec stated that Bellway has returned to “growth mode” with a more positive outlook compared to the last few years.

Similarly, AJ Bell investment director Russ Mould praised the numbers, stating that “the stars are finally aligning for the housebuilding sector.” He further added that the group holds a substantial portfolio of land poised for new housing developments, which is expected to support future profits.

Are Bellway Shares a Good Buy?

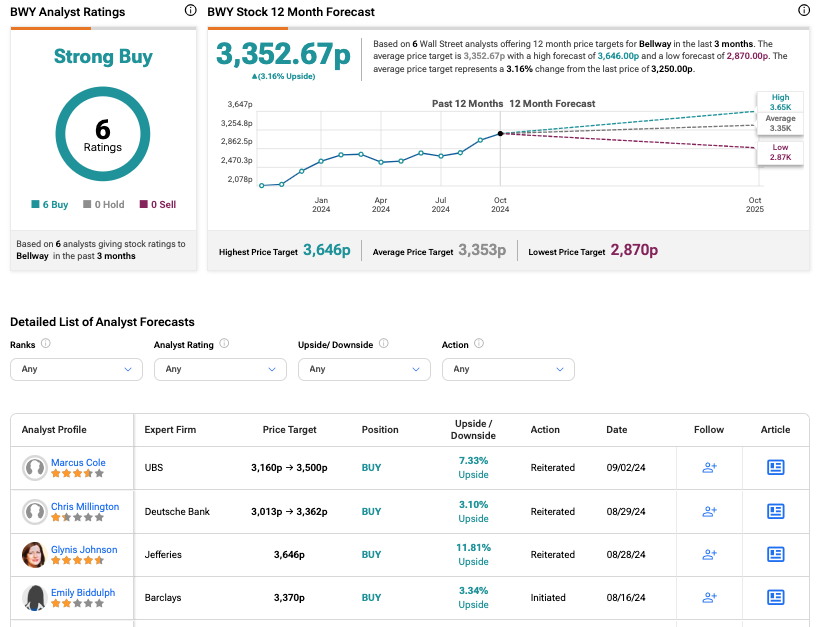

BWY stock has received a Strong Buy rating on TipRanks, backed by six Buy recommendations. The Bellway share price forecast is 3,352.67p, which is 3.16% higher than the current trading level.