Shares in biopharma Bellus Health (BLU) cratered 72% in Monday’s trading, after the company announced disappointing topline results from its Phase 2 RELIEF trial of BLU-5937 in patients with refractory chronic cough.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Phase 2 RELIEF trial of BLU-5937 did not achieve statistical significance for the primary endpoint of reduction in placebo-adjusted cough frequency at any dose tested.

However a clinically meaningful and highly statistically significant placebo-adjusted reduction in cough frequency was achieved in a pre-specified sub-group of high cough count patients (all patients at or above the baseline median average of 32.4 coughs per hour).

BLU-5937 was well tolerated with no serious adverse events reported and no withdrawals due to treatment-related adverse events at any dose.

“While we had hoped to see more response in the lower cough patients, BLU-5937 and other P2X3 antagonists may have the most benefit in patients with a greater disease burden,” stated CEO Roberto Bellini.

“We believe the Phase 2 data support moving BLU-5937 forward into an adaptive Phase 2b trial enriched for higher cough count patients. We expect to begin this trial in the fourth quarter of 2020” he added.

RELIEF enrolled a total of 68 refractory chronic cough patients from 16 sites in the UK and US, with 52 completing both treatment periods. Sixteen patients dropped out in total, 13 due to COVID-19 difficulties and 3 with additional non-drug related discontinuations.

“While we are surprised/disappointed by the efficacy data (especially since three other assets in the class have read out positively), we do not think this is the end of the road for Bellus, but that it will take longer and be a bit more complex than previously expected” LifeSci Capital’s Sam Slutsky told investors following the announcement.

He noted that the asset was associated with a low-incidence of taste side effects at all doses, solidifying its favorable tolerability profile versus the P2X3 inhibitors from Merck and Bayer, and maintains his view that BLU-5937 has a profile that can be successfully advanced.

What’s more, Slutsky cited cough expert Professor Morice who commented that the high dropout rate as a result of the pandemic may have played a role in the primary endpoint not reaching statistical significance.

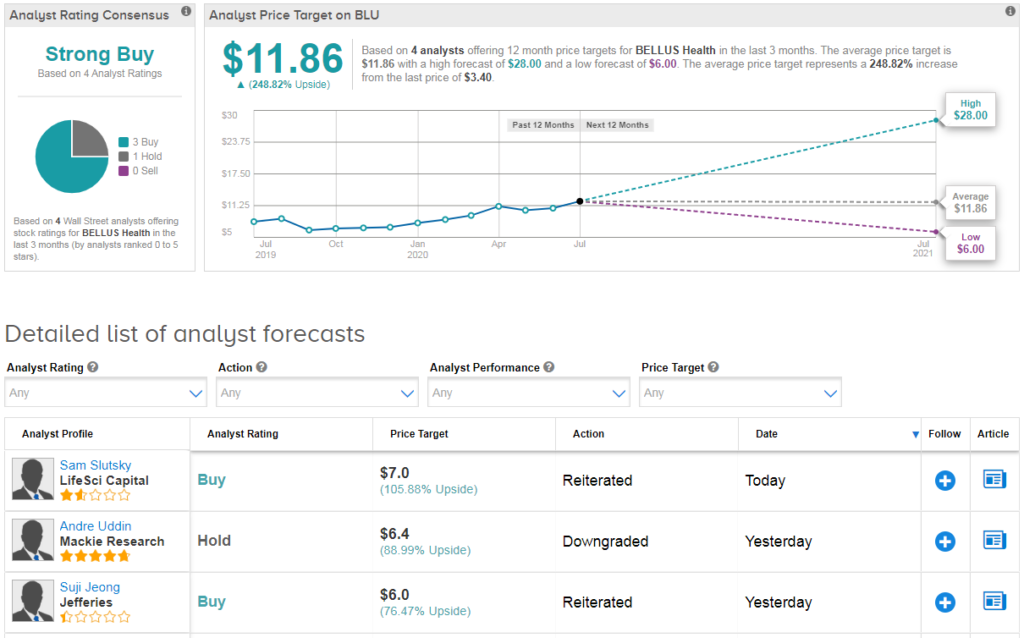

As a result the analyst reiterated his buy rating on the stock with a price target of $7, down from $17 previously. Overall the stock scores a bullish Strong Buy rating from the Street, with three recent buy ratings vs 1 hold rating. (See BLU stock analysis on TipRanks)

Related News:

Chembio Gains 12% After-Hours On New Covid-19 BARDA Contract

CytoDyn Signs Distribution Deal For Covid-19 Treatment Leronlimab

Cellectis Sinks 13% In Extended Trading After FDA Halts Cancer Clinical Trial