An unexpected marketing development arrived for entertainment giant Warner Bros. Discovery (WBD) recently, as a study from Ampere Analysis revealed that Warner is one of the biggest names around when it comes to alcohol advertising spending. The news oddly unsettled investors, though, and shares slipped modestly in the closing minutes of Thursday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

HBO Max is actually the second-largest share of alcohol advertising, just under Disney’s (DIS) Hulu. Interestingly, Disney+ itself is in third place, followed by Comcast’s (CMCSA) Peacock in fourth and Warner’s Discovery+ in fifth. So while Disney is actually the front-runner, Warner is second place.

As it turns out, alcohol ad buyers are particularly interested in two key points when it comes to ad spend. They want to advertise on shows that involve food and drink—think The Bear on Hulu—or any kind of high-end drama like Criminal Minds or The Sopranos. And this is where an unexpected new wrinkle enters the field. Alcohol advertisers like these shows, and Netflix (NFLX) is proving to be a major draw in those sectors thanks to a range of cooking competition shows, food-related shows, and dramas. That makes for a spread tailor-made for ad buyers.

Merger Ahead?

Meanwhile, we still have the issue of a possible merger to consider. As Warner may be preparing to receive a bid from Paramount Skydance (PSKY), or potentially even from Netflix, we will have to watch and wait. There are those advancing the idea that any buyout will come after a planned split between Warner Bros and Discovery Global, but some wonder if perhaps it will come beforehand to get access to the whole shooting match.

And with Paramount still licking its wounds after the protracted merger that brought together Paramount and Skydance to begin with, Paramount Skydance may want to move more rapidly than some might think while Paramount’s assets are still reasonably well-valued.

Is WBD Stock a Good Buy?

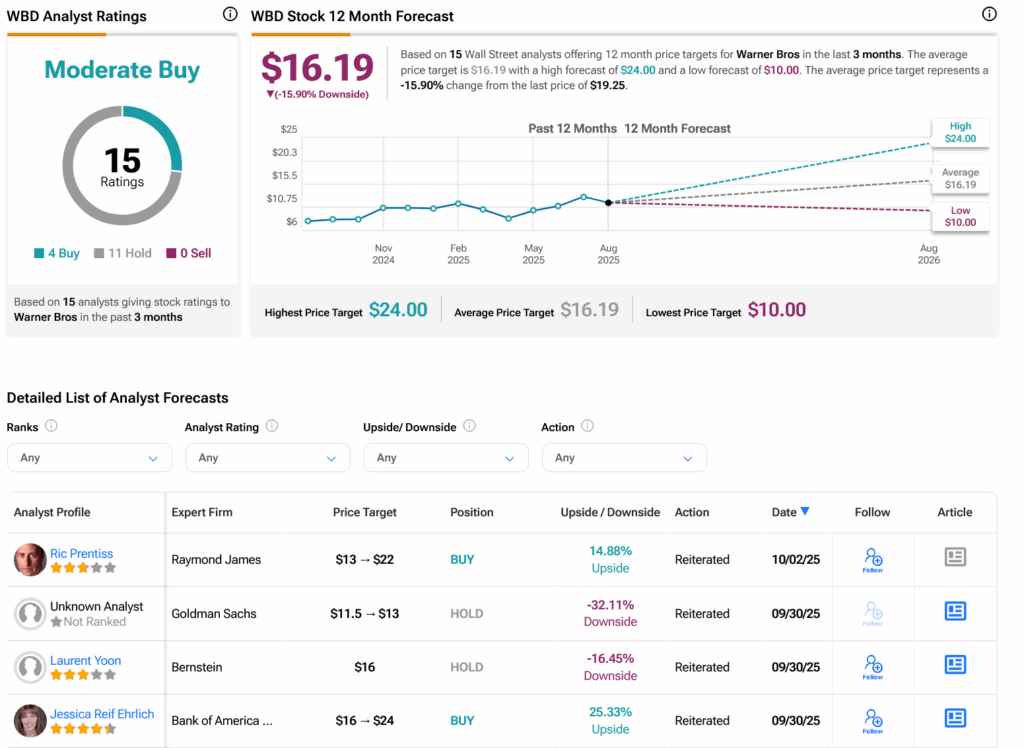

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on four Buys and 11 Holds assigned in the past three months, as indicated by the graphic below. After a 145.04% rally in its share price over the past year, the average WBD price target of $15.50 per share implies 15.9% downside risk.