Shares of Bed Bath & Beyond Inc. (NASDAQ: BBBY) tanked more than 23% at Wednesday’s close. The drop in price followed disappointing first-quarter Fiscal 2022 (ended May 28) results and the departure of the company’s CEO, Mark Tritton. The company operates retail stores and sells domestic merchandise and home furnishings.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Harriet Edelman, Independent Chair of Bed Bath & Beyond’s Board, said, “After thorough consideration, the Board determined that it was time for a change in leadership…Today’s actions address company performance, the macroeconomic conditions under which we are operating, and the expectations of the Board on behalf of shareholders. We are committed to addressing the urgent issues that have been impacting sales, profitability, and cash flow generation.”

Sue Gove will act as an Interim CEO, replacing Mark Tritton.

Results in Detail

Bed Bath & Beyond incurred an adjusted loss of $2.83 per share, far more than the Street’s estimated loss of $1.39 per share. The company reported earnings of $0.05 per share in the same quarter last year.

Net sales generated during the quarter plunged 25% year-over-year to $1.46 billion, below the consensus estimate of $1.51 billion.

Changes in consumer spending behavior and a decline in the home sector (which contributes 70% of net sales) demand resulted in a 27% decrease in Bed Bath & Beyond banner comparable sales. Unfortunately, comparable sales fell 24% in stores and 21% in the digital channel.

The buybuy BABY banner comparable sales were down in the mid-single-digits on a year-over-year basis.

Adjusted gross margin came in at 23.8%, significantly down from 34.9% in the prior-year quarter. The margin was severely impacted by transient costs related to markdown inventory reserves and supply chain-associated port fees.

Commenting on the results, Ms. Gove said, “I step into this role keenly aware of the macro-economic environment. In the quarter there was an acute shift in customer sentiment and, since then, pressures have materially escalated. This includes steep inflation and fluctuations in purchasing patterns, leading to significant dislocation in our sales and inventory that we will be working to actively resolve.”

Outlook for Fiscal 2022

Management expects sequential comparable sales recovery in the second half of Fiscal 2022, on the back of inventory optimization plans. Additionally, adjusted SG&A expense is expected to contract on a year-over-year basis following the alignment of the cost structure to sales.

Capital expenditures are expected to be about $300 million, down from prior expectations of $400 million, as the company plans to pause remodels and new store openings for the remainder of Fiscal 2022.

Website Traffic

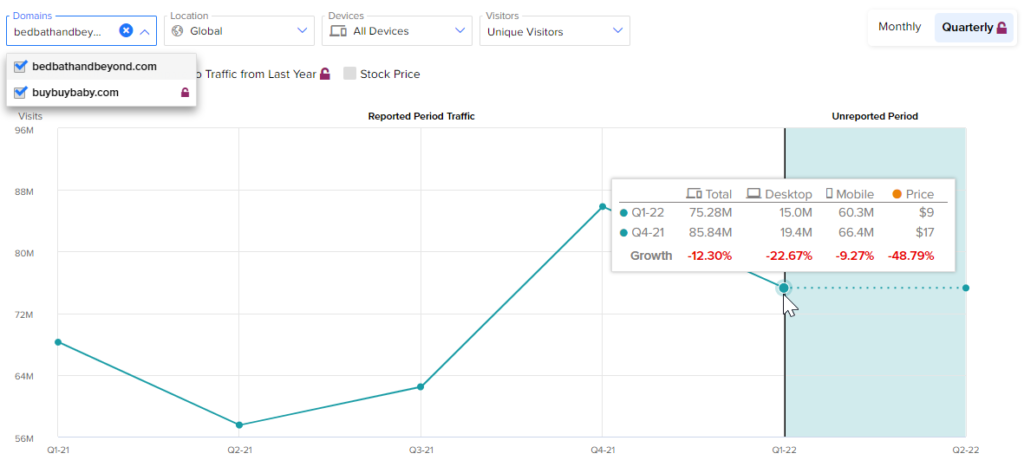

The earnings results were evident on TipRanks’ new tool that measures visits to Bed Bath & Beyond’s websites. Pre-earnings, we were able to see insights into Bed Bath & Beyond’s performance in the fiscal first quarter.

According to the tool, Bed Bath & Beyond websites recorded a 12.30% decrease in global visits in Fiscal Q1 2022 compared to the prior quarter. Also, year-to-date website growth, compared to year-to-date website growth in the previous year, came in at a decline of 16.89%. This, in turn, indicated that the company might report disappointing results in the first quarter.

The predictions that were based on TipRanks’ website visits data turned out to be correct, with Bed Bath & Beyond reporting lower-than-expected results in Fiscal Q1 2022.

Wall Street’s Take

Following the Bed Bath & Beyond earnings report, Wells Fargo analyst Zachary Fadem maintained a Sell rating on the stock and reduced the price target to $3 (39.88% downside potential) from $5.

Fadem said, “While extremely challenging results were well telegraphed (via softening consumer sentiment, inflation, etc.), a steeper-than-expected Q1 margin shortfall, CEO departure, and less likely buybuy BABY monetization represent incremental negatives for us.”

The five-star analyst added, “And with Q2-to-date comps tracking in the -20%s (vs. -10% Q2 Consensus) into heightened clearance and a deteriorating macro, we believe it’s safe to say BBBY’s turnaround looks increasingly in doubt. Coupled with a problematic balance sheet (dwindling cash, rising leverage, etc.), and likely more negative revisions ahead, we see more downside.”

The rest of the Street is bearish on the stock with a Moderate Sell consensus rating. That’s based on four Holds and eight Sells. The average Bed Bath & Beyond price target of $6.33 implies 26.85% upside potential to current levels. Shares have decreased more than 85% over the past year.

Also, BBBY gets a 1 out of 10 on TipRanks’ Smart Score ranking, suggesting that it is likely to underperform market expectations.

Besides, per TipRanks’ Hedge Fund Trading Activity tool, hedge funds have decreased their exposure to BBBY stock. The cumulative change in holdings across all 5 hedge funds that were active in the last quarter was a decrease of 231,600 shares.

Bottom-Line

Bed Bath & Beyond is undergoing a transformation with a number of strategic actions and leadership changes. Amid the current macro headwinds, which include supply-chain concerns, cost pressure, and changes in consumer spending habits, investors should exercise caution before investing in this stock. Analysts’ bearish stance and hedge funds’ actions are also unfavorable.

Read full Disclosure