Best Buy (BBY) and Target (TGT) are two lagging retailers that have been dealt a pretty tough hand amid inflation and a rather sluggish consumer environment. Indeed, inflation has pushed consumers to be more selective about spending the limited extra dollars in their pockets. Despite the choppy rides to be had with both hard-hit retail plays (note that the beta on shares of BBY and TGT are well above 1.0, signifying above-average market risk), I’m inclined to stay bullish on both stocks.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Undoubtedly, there are notable macro pressures facing each bruised (but not battered) retailer. Inflation has been a headwind that is relatable to all firms within the retail scene. That said, some retailers have been able to swim forward against the current more effectively than others.

Some Retailers Have Swum Forward, Others Have Sunk

Firms like Walmart (WMT) have made the most of higher prices to make competitive strides over rivals like Target by better catering to crowds that have become increasingly price-sensitive. But just how much of Walmart’s relative outperformance (don’t look now, but WMT stock recently hit all-time highs) is due to it being fortunate to have a much larger grocery business, and how much was due to smart moves made by management?

It’s hard to say, but a strong case could be made that Walmart is what legendary investor Phil Fisher would describe as “fortunate because they are able.” Now, what does that even mean? Walmart positioned itself as a share-taker by offering low prices and a seamless omnichannel shopping experience, even before inflation was on anyone’s radar.

Looking ahead, Target and Best Buy stand out as retailers that are “fortunate and able,” as consumer spending improves once inflation and high rates take some pressure off their wallets. What does being fortunate and able entail? In the case of Target and Best Buy, it means both firms are well-equipped to cash in on an upward turn in discretionary consumer spending.

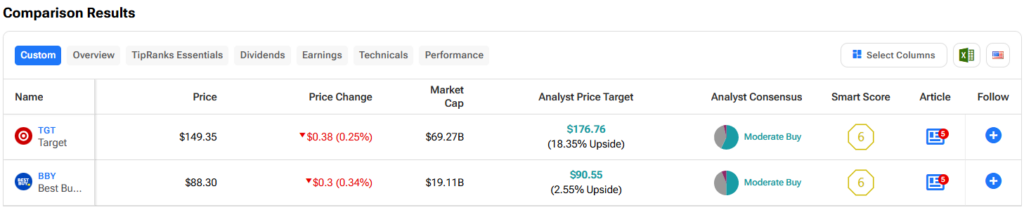

Now, let’s tune into TipRanks’ Comparison Tool to stack up the two retail stocks and see where analysts stand.

Target (NYSE:TGT)

Like Walmart, Target has also taken numerous steps to improve its ability to withstand a consumer spending slowdown. Many years ago, the company made an effort to expand its grocery business to become less of a discretionary retailer and slightly more of a consumer defensive that consumers would shop at more frequently.

Looking ahead, Target plans to open 300 new large-format locations with “expanded” grocery sections over the next 10 years. Indeed, it looks like all new Target locations will be more Walmart-esque.

Just how large will these super-sized Target stores be? They will be approximately 150,000 square feet (sqft), about 20,000 sqft larger than your average Target today. That’s more than enough room to fit in a traffic-driving grocery business. Perhaps in 10 years, the Target of the future will be better able to withstand recessions and inflation surges than the present-day Target.

Further, in late June, Target made another Walmart-esque move by cutting prices on thousands (close to 5,000 by the time summer rollbacks are done) of products. Nothing beckons consumers back into stores than lower prices.

Additionally, Target has been betting big on boosting its e-commerce business with the addition of same-day delivery through its Target Circle 360 membership (which mirrors Walmart+) and the ability to easily pick up orders made through the online platform. Combined with the new push into private-label brands (a worthy rival to Walmart’s Great Value?), Target looks like a firm poised to catch up to Walmart as Walmart looks to target Amazon (AMZN).

At 17.1 times trailing price-to-earnings (P/E), far less than top peer WMT, perhaps TGT stock is the better value pick for investors looking for a catch-up trade in retail.

What Is the Price Target of TGT Stock?

TGT stock is a Moderate Buy, according to analysts, with 16 Buys, 11 Holds, and one Sell assigned in the past three months. The average TGT stock price target of $176.76 implies 18% upside potential.

Best Buy (NYSE:BBY)

Best Buy is a vastly different retail play than Target, but it’s one that could face far timelier catalysts. The electronics retailer has been sagging lower in recent years because many consumers were already content with their gadgets bought at the peak of the pandemic-induced lockdown. For many consumers, it just does not make sense to upgrade your laptop, phone, television, tablet, or audio system every year, especially when the costs of living rocket.

In essence, the electronics boom from the 2021 pandemic-fueled work-home-home (WFH) surge was a pull forward in demand that inevitably led to an ensuing demand hangover. Indeed, it’s not hard to imagine that demand from the past two and half years was met way back in 2021 when people had excess savings to spend on tech to work and play from home.

It’s hard to tell just how many years’ worth of demand were pulled forward in 2021. Regardless, I see the tides turning as artificial intelligence (AI) makes its way to this year’s device slate.

As DA Davidson analyst Michael Baker put it, the four-year PC replacement cycle from lockdown will happen in 2024. Not only are PC (and Mac) devices long overdue for an upgrade, but “AI capabilities” could help “upgrade cycles gain momentum.” He’s right. At four years old, a lot of consumer tech is now dated. And with AI rolling into the latest PCs, that tech could soon look ancient.

At 15.5 times trailing P/E, BBY stock trades at a discount to the specialty retail industry average of 21.0 times. And that’s despite Best Buy’s unique positioning ahead of an AI-powered PC refresh cycle.

What Is the Price Target of BBY Stock?

BBY stock is a Moderate Buy, according to analysts, with eight Buys, seven Holds, and one Sell assigned in the past three months. The average BBY stock price target of $90.55 implies 2.3% upside potential.

The Takeaway

Moving ahead, there is room for hope with TGT and BBY as rates turn lower and each retail play looks to make the most of its own unique and perhaps timely catalysts that could be lying ahead. Target is striving to become more like Walmart every day. Meanwhile, Best Buy is ready to serve consumers that are finally ready to upgrade their devices to be more compatible with AI.