Shares of Best Buy (BBY) declined in pre-market trading after the company slashed its FY24 forecast and its Q3 results fell short of expectations. The consumer electronics retailer narrowed its FY24 revenue outlook and now expects revenues in the range of $41.1 billion to $41.5 billion, compared to its prior outlook of $41.3 billion to $41.9 billion. Additionally, comparable sales are likely to drop in the range of 3.5% to 2.5%, compared to its previous forecast of a decline between 3% and 1.5%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Furthermore, adjusted earnings are likely to be in the range of $6.10 to $6.25 per share in FY24, compared to its previous guidance of $6.10 to $6.35. For reference, analysts were expecting the company to report adjusted earnings of $6.27 per share on revenues of $41.6 billion.

In the fourth quarter, the retailer anticipates that comparable sales will be flat or decline by 3% year-over-year.

BBY’s Q3 Results Fall Short of Expectations

Meanwhile, the retailer’s adjusted earnings declined by 2% year-over-year to $1.26 per share in the third quarter. This was below consensus estimates of $1.29 per share.

Furthermore, the company’s revenues declined by 3.2% year-over-year to $9.45 billion, falling short of Street estimates of $9.6 billion. Additionally, BBY’s comparable sales declined by 2.9% in the third quarter.

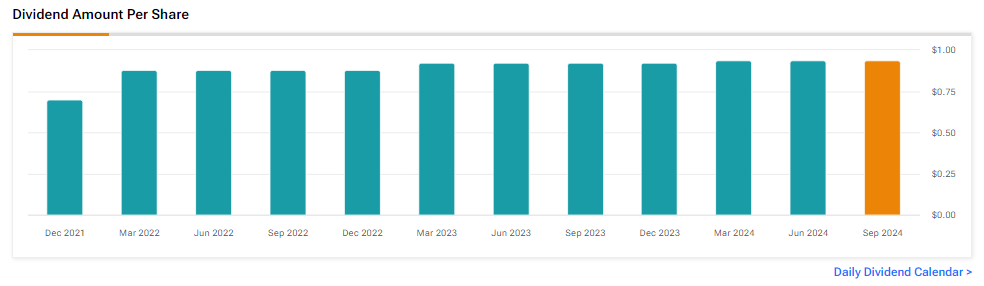

BBY Announces Quarterly Dividend

In addition, BBY announced a quarterly cash dividend of $0.94 per common share payable on January 7, 2025, to shareholders of record as of the close of business on December 17. Furthermore, the company bought back stock worth $137 million in the third quarter.

What Is the Future of BBY Stock?

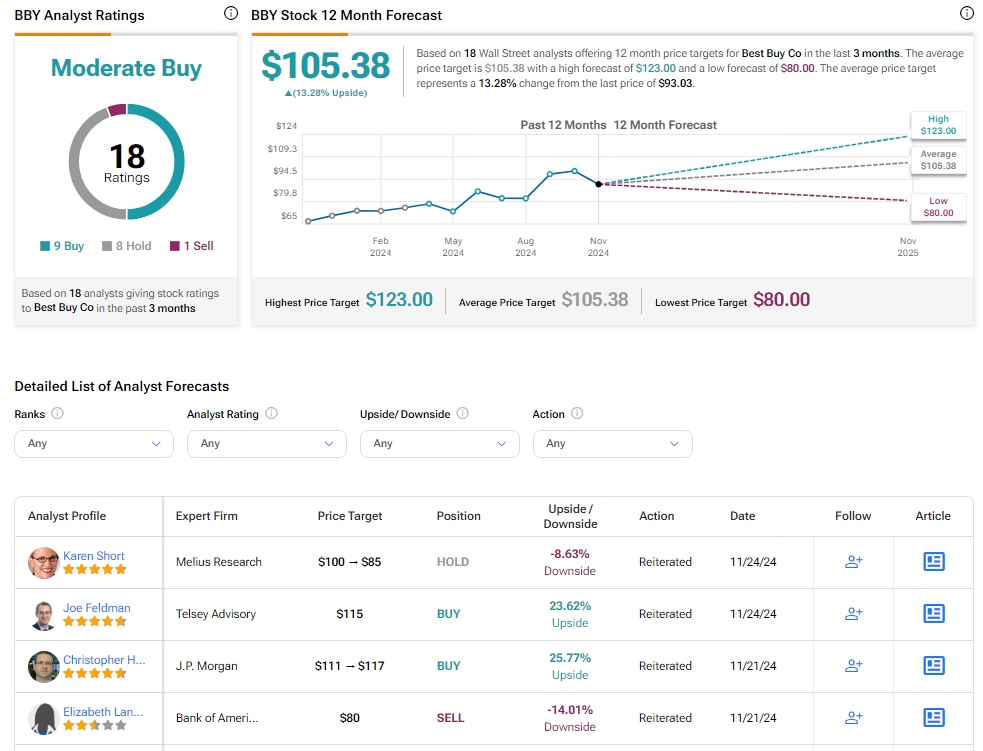

Analysts remain cautiously optimistic about BBY stock, with a Moderate Buy consensus rating based on nine Buys, eight Holds, and one Sell. Over the past year, BBY has surged by more than 35%, and the average BBY price target of $105.38 implies an upside potential of 13.3% from current levels. These analyst ratings are likely to change following BBY’s results today.