Best Buy (NYSE:BBY) reported mixed first-quarter results on Thursday. The consumer electronics retailer generated revenues of $8.85 billion in the first quarter, a decline of 6.5% year-over-year, falling short of consensus estimates of $8.96 billion. BBY’s comparable sales declined by 6.1% in Q1.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The retailer reported adjusted Q1 earnings of $1.20 per share, up by 4.3% year-over-year, beating analysts’ consensus estimate of $1.08 per share.

BBY’s Sales Breakdown

The company’s domestic business segment continued to be the biggest contributor to the retailer’s business, accounting for more than 90% of its total Q1 revenues. The domestic business segment generated sales of $8.2 billion, marking a decline of 6.8% year-over-year.

The company’s management noted that macroeconomic factors have created a “challenging sales environment,” resulting in lower-than-expected sales.

BBY’s FY25 Guidance

Looking forward, management stated that the company expects comparable sales to decline by around 3% in the second quarter and adjusted operating income to be approximately 3.5%.

For FY25, BBY expects revenues to be in the range of $41.3 billion to $42.6 billion, while adjusted diluted earnings are likely to be between $5.75 and $6.20 per share. Comparable sales are projected to decline by 3% or remain stagnant.

BBY’s Stock Buyback and Dividends

In Q1 FY25, the company paid dividends worth $202 million and engaged in a stock buyback of $50 million, returning a total of $252 million to shareholders.

Additionally, BBY announced that its board of directors has authorized a regular quarterly cash dividend of $0.94 per common share. The quarterly dividend will be payable on July 11 to shareholders of record as of the close of business on June 20, 2024.

What Is the Future of BBY Stock?

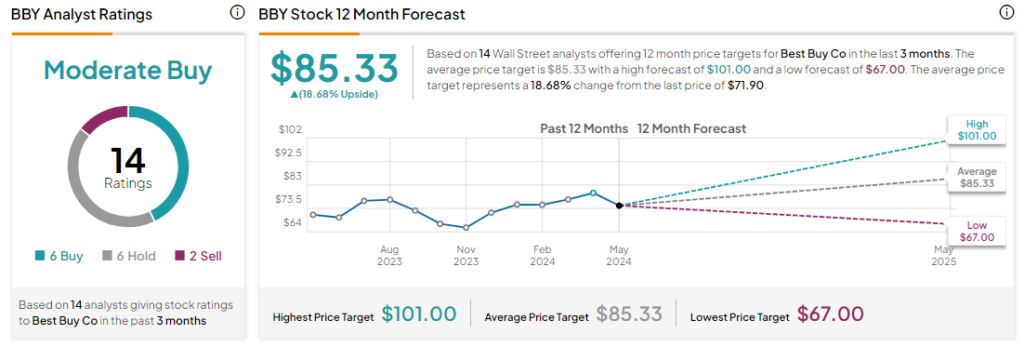

Analysts remain cautiously optimistic about BBY stock, with a Moderate Buy consensus rating based on six Buys and Holds each and two Sells. Year-to-date, BBY has declined by more than 6%, and the average BBY price target of $85.33 implies an upside potential of 18.7% from current levels. These analyst ratings are likely to change following BBY’s Q1 results today.