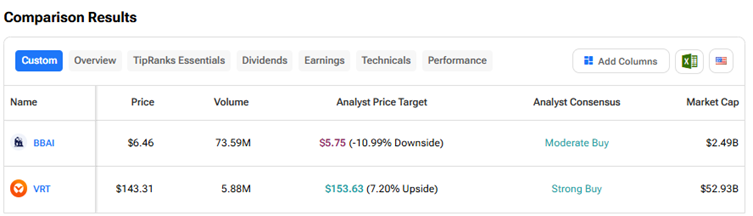

Massive investments in artificial intelligence (AI) infrastructure and elevated valuations of several AI stocks are weighing on investor sentiment. Despite ongoing concerns, Wall Street remains bullish on several AI-focused companies that are delivering strong financials and securing attractive deals to drive continued growth. Using TipRanks’ Stock Comparison Tool, we place BigBear.ai Holdings (BBAI) and Vertiv Holdings (VRT) against each other to find the better AI pick, according to analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

BigBear.ai Holdings (NYSE:BBAI) Stock

BigBear.ai offers AI-powered decision intelligence solutions. Despite the company’s unimpressive second-quarter results and a full-year revenue guidance cut due to disruptions in federal contracts resulting from cost-cutting and efficiency efforts, BBAI stock has gained 27% over the past month. The stock has risen more than 45% year-to-date.

While concerns exist about BBAI stock’s valuation, particularly due to its dismal top-line performance, bulls remain optimistic about the company’s potential to secure large government contracts, with the “One, Big, Beautiful Bill” seen as a major catalyst.

What Is the Price Target for BBAI Stock?

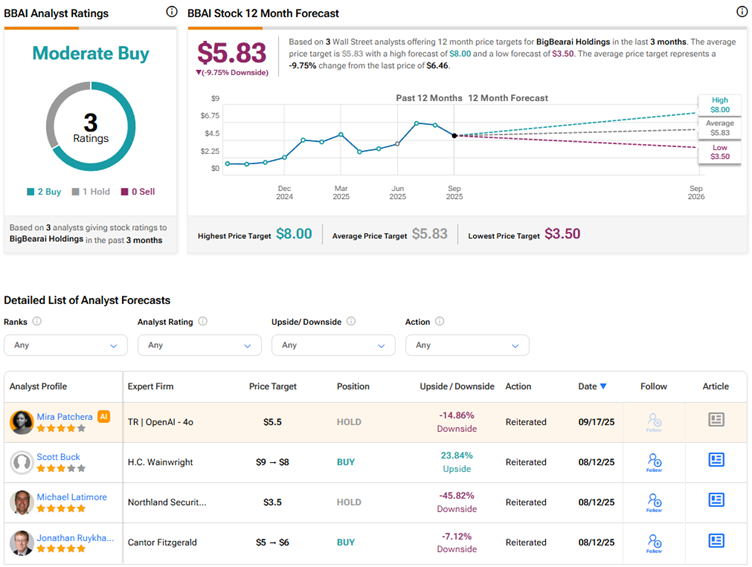

In August, H.C. Wainwright analyst Scott Buck slightly lowered his price target for BigBear.ai Holdings stock to $8 from $9 but reiterated a Buy rating. Buck contended that while BBAI’s Q2 results were disappointing, it was not surprising, given that other players in the defense space also experienced program delays. The analyst expects better revenue visibility as BBAI progresses into 2026.

In the longer term, Buck believes that BigBear.ai is well-positioned to benefit from the “One, Big, Beautiful Bill,” which involves increased investments in areas aligned with the company’s core competencies.

Currently, Wall Street is cautiously optimistic on BigBear.ai Holdings stock based on two Buys and one Hold recommendation. The average BBAI stock price target of $5.83 indicates a 9.8% downside risk from current levels.

Vertiv Holdings (NYSE:VRT) Stock

Vertiv Holdings offers power, cooling, and IT infrastructure solutions and services to data centers, communication networks, and commercial and industrial facilities. VRT stock has risen more than 26% year-to-date, driven by robust demand for AI infrastructure to support the growing number of data centers.

While the announcements about the development of new cooling systems by tech giants Microsoft (MSFT) and Amazon (AMZN) have raised concerns about growing competition, most analysts remain bullish on Vertiv stock due to the massive total addressable market for data center infrastructure amid the ongoing AI boom.

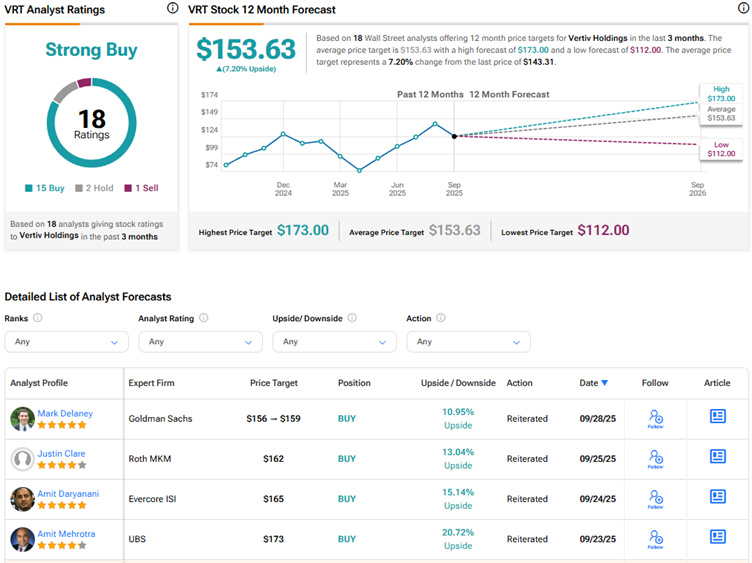

Is VRT Stock a Good Buy?

Last week, VRT stock fell on the news of Microsoft successfully testing a new microfluidic cooling system for data center chips. Reacting to the news, Roth Capital analyst Justin Clare reiterated a Buy rating on Vertiv Holdings stock with a price target of $162, stating that the pullback in the stock offers a buying opportunity.

The 4-star analyst does not expect Microsoft’s innovation to have a material impact on the content Vertiv supplies to data centers. Clare believes that the recent announcements from Oracle (ORCL) and OpenAI also reinforce a strong demand backdrop for data center infrastructure.

Overall, Wall Street has a Strong Buy consensus rating on Vertiv Holdings stock based on 15 Buys, two Holds, and one Sell recommendation. The average VRT stock price target of $153.63 indicates 7.2% upside potential.