Germany-based Bayer AG (DE:BAYN) has secured a deal with U.S.-based biotech firm Cytokinetics (CYTK) to market the latter’s experimental heart drug in Japan. According to the partnership, Bayer will develop and market Cytokinetics’ Aficamten exclusively in Japan. Aficamten is a next-generation cardiac myosin inhibitor being developed for the potential treatment of patients with hypertrophic cardiomyopathy (HCM).

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Bayer specializes in research and manufacturing across the pharmaceuticals, consumer health, and crop science sectors.

Bayer Expands Portfolio Under Growing Investor Pressure

Over the last few years, Bayer has been facing pressure from investors to improve its pharmaceutical pipeline, sluggish agricultural markets, and significant litigation costs.

Recently, Bayer forecast a decline in its earnings for 2025, primarily due to a slump in its agriculture division. This suggests a third consecutive annual decline in the company’s EBITDA (earnings before interest, tax, depreciation, and amortization). Consequently, its shares plummeted to a 20-year low, increasing investor pressure. Year-to-date, BAYN stock has dropped more than 40%.

To combat this, the company is focusing on smaller deals to grow its pharmaceutical portfolio. Through its partnership with Cytokinetics, Bayer aims to strengthen its cardiovascular portfolio as part of its strategy to improve heart disease treatments.

With this deal, Bayer gets the rights to market the drug in Japan, while Cytokinetics retains certain development rights. Meanwhile, Cytokinetics will receive an upfront payment of €50 million, with the potential for an additional €90 million upon reaching milestones through the commercial launch.

Is Bayer Stock a Good Buy?

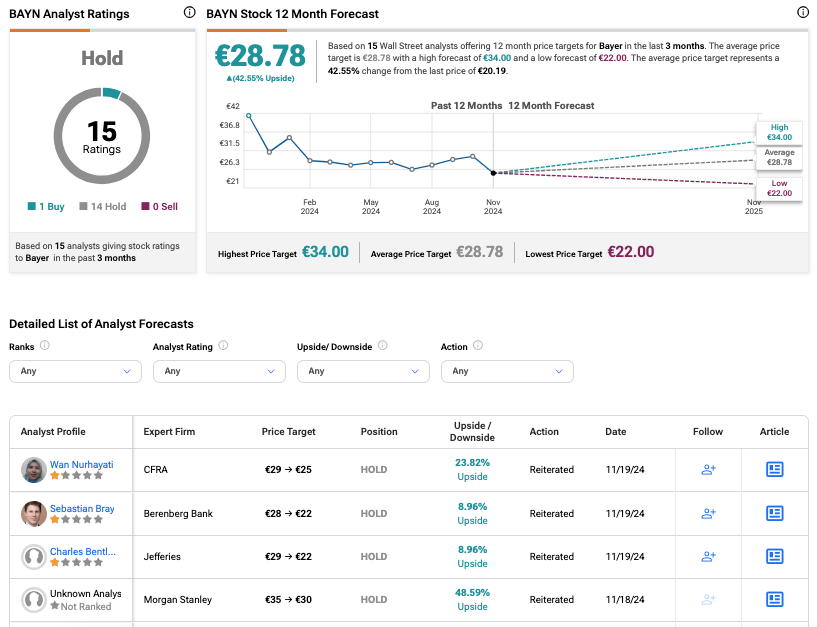

Following the deal, analysts from CFRA, Jefferies, and Berenberg Bank confirmed their Hold ratings on BAYN stock yesterday.

Overall, BAYN stock has a Hold consensus rating based on one Buy and 14 Holds assigned in the last three months. At €28.78, the average Bayer price target implies 42.55% upside potential.