Shares of Bath & Body Works (NYSE:BBWI) are in focus today after the specialty retailer announced its results for the third quarter, with revenue declining by 2.6% year-over-year to $1.56 billion. EPS of $0.48 outpaced expectations by $0.13.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company is experiencing gains from its cost optimization initiatives alongside robust merchandise margins. Notably, operating income for the quarter increased by $19 million to $221 million despite a challenging macro environment.

Next, BBWI has updated its outlook for Fiscal year 2023 to reflect an anticipated decline in sales, as well as an improving bottom line. The company expects net sales to decline by 2.5% to 4% alongside an EPS range of $2.90 to $3.10 for the year.

For the upcoming quarter, BBWI sees net sales declining by 1% to 5% alongside an EPS range of $1.70 to $1.90.

Is BBWI a Good Stock?

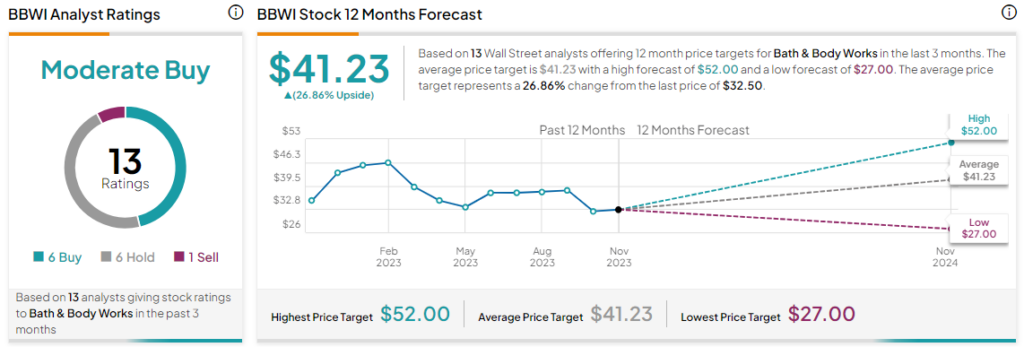

Overall, the Street has a Moderate Buy consensus rating on Bath & Body Works. Following a nearly 25% slide in the company’s share price so far this year, the average BBWI price target of $41.23 implies a nearly 26.9% potential upside in the stock.

Read full Disclosure