Barrick Gold Corp. (TSE:ABX) (NYSE:GOLD), a leading producer of precious metals, is evaluating a site in Indonesia to build an exploration plant for potential gold and copper mining opportunities across an Asia Pacific corridor. The site has not been confirmed yet but is under consideration, as reported by Bloomberg.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Tethyan Eurasian metallogenic belt, an underground mineral corridor stretching from Indonesia to Pakistan, is rich in gold and copper. Also, Barrick owns sites at both ends of the belt — the Porgera gold mine in Papua New Guinea and the Reko Diq copper-gold mine in Pakistan.

Indonesia is abundantly endowed with important metals and minerals, including nickel, copper, and gold.

Is Barrick Gold Worth Buying?

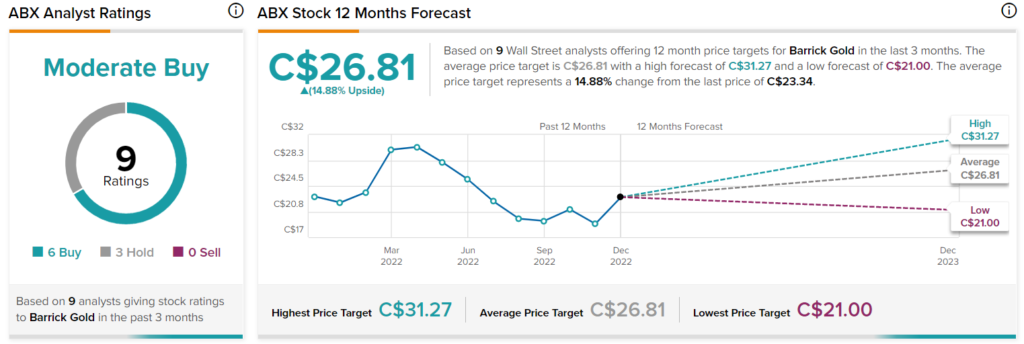

Wall Street is cautiously optimistic about Barrick, with a Moderate Buy rating based on six Buys and three Holds. The average price target of C$26.81 indicates that the current price has the potential to grow 14.88% over the next year. Shares of the company have appreciated by 1.7% so far this year.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.