It was a good day for gold stock Barrick Gold (TSE:ABX) (NYSE:GOLD). Its earnings report offered several significant advances against comparisons to last year’s third quarter. Yet investors weren’t quite so enthralled, sending shares down fractionally in Thursday morning’s trading.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Barrick Gold, a gold mining operation based in Toronto, elects to keep its books in dollars, which makes translation on that front easier. Barrick Gold brought in $368 million in profit in its third quarter, which blew away third quarter 2022 figures of $241 million. Further, earnings per share also came up much better, coming in at $0.24 per share adjusted against $0.13 per share. Revenue outright came in at $2.86 billion against $2.53 billion in 2022’s third quarter, mostly the result of increased gold prices in the meantime. Barrick Gold also did brisk business in copper sales, though not as brisk as the third quarter of 2022. Copper sales came in at 101 million pounds, but 2022’s third quarter featured 120 million pounds sold.

Barrick Gold didn’t have things all its own way, however; it recently fell prey to a critical vulnerability found in MOVEit, a secure file transfer program. Barrick Gold sent out notices of the data breach to all impacted customers, as whoever exploited the vulnerability was able to access “sensitive information.” While publicly-available notices sent to the Montana Attorney General didn’t reveal what kind of data was accessed, the individual notices likely offered more information. Barrick Gold also offered an update about its Pueblo Grande project in the Dominican Republic. It expects drilling will be complete by the end of this month, featuring a total of 3,000 meters’ worth of drilling in 10 holes in its second phase of drilling operations.

Is Barrick Gold Stock a Good Buy?

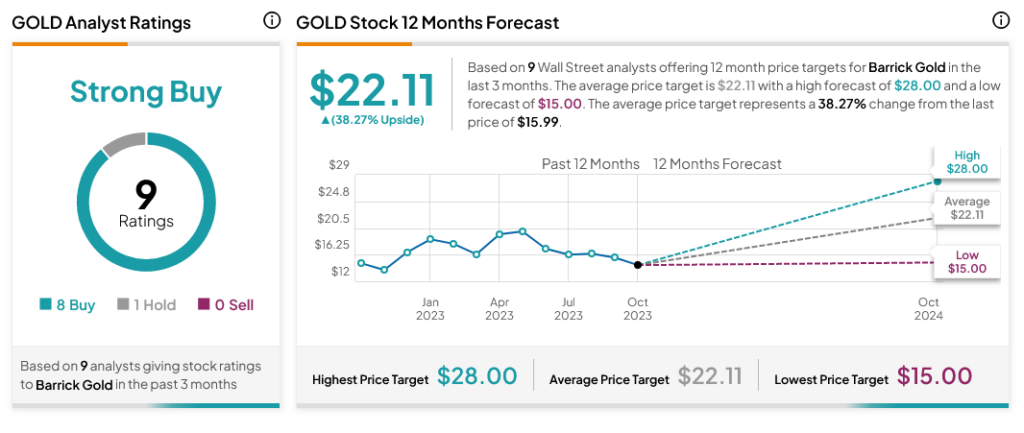

Turning to Wall Street, analysts have a Strong Buy consensus rating on GOLD stock based on eight Buys and one Hold assigned in the past three months, as indicated by the graphic below. Furthermore, the average GOLD price target of $22.11 per share implies 38.27% upside potential.