You can always find a bargain on the stock market. Here are three stocks which could be easily overlooked if we didn’t have our AI analyst on hand.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

They are Euro Tech Holdings (CLWT), Acorn Energy (ACFN) and Innovative Solutions and Support (ISSC).

That’s according to the TipRanks AI Analyst Top Stocks Screener Tool.

The tool helps investors scan stocks that our AI analysts have screened and ranked on a range of criteria from earnings results to technical analysis.

Triple Appeal

Euro Tech Holdings primarily distributes water treatment equipment, laboratory instruments, analyzers, test kits and related supplies, and power generation equipment to commercial customers, and governmental agencies in Hong Kong and the People’s Republic of China.

It has a market cap of just over $10 million.

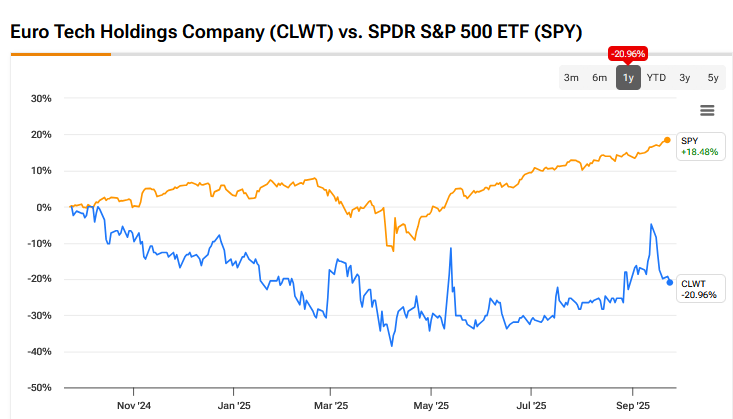

Our AI analyst gives the company a score of 72 and a Buy rating. It has a price target of $2, implying a 50.38% upside – see below:

It scores well due to strong technical indicators and a solid financial foundation with low leverage. However, concerns about revenue volatility and the lack of dividend yield slightly temper the overall score.

Acorn Energy through its subsidiaries, develops and markets wireless remote monitoring and control systems for various markets in the United States and internationally. It operates through two segments, Power Generation (PG) Monitoring and Cathodic Protection (CP) Monitoring.

It has a market cap of just over $72 million.

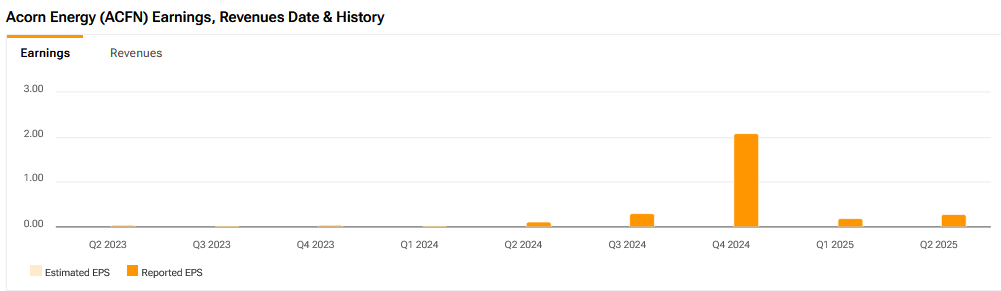

Our AI analyst has given the company a score of 81 and a Buy rating. It has a price target of $35, implying a 21.53% upside.

Its strong financial performance and positive earnings call sentiment are the primary drivers of its high score. The technical indicators support a bullish outlook, while the valuation remains reasonable. The NASDAQ uplisting enhances the company’s visibility and growth prospects, despite some challenges in specific market segments.

Acorn Energy has demonstrated strong revenue growth, with a 36.37% increase in 2024 compared to 2023. The company has achieved a significant turnaround in profitability, with a net profit margin of 57.29% in 2024, up from 1.48% in 2023.

Innovative Solutions and Support is a systems integrator which designs, develops, manufactures, sells, and services flight guidance, autothrottle, and cockpit display systems in the United States and internationally.

It offers flat panel display systems that replicate the display of analog or digital displays on one screen and replace existing displays in legacy aircraft, as well as used for security monitoring on-board aircraft and as tactical workstations on military aircraft; and flight management systems that complement the flat panel display system upgrade for commercial air transport aircraft.

It has a market cap of just over $200 million. Our AI analyst has given it a score of 75 and a Buy rating. It has a price target of $15, implying a 31.58% upside.

Our AI analyst says it shows strong financial performance and strategic growth initiatives, supported by a new credit facility. While technical indicators suggest short-term weakness, the stock’s valuation remains attractive. The company’s ability to manage cost pressures and leverage will be crucial for sustaining growth.

To find more AI Analyst stocks like these, check out our TipRanks AI Analyst Top Stocks Screener Tool.