Barclays five-star analyst Tim Long kept a Sell rating today on Apple (AAPL). At the same time, he held his $230 price target, which he raised from $180 in November. As a result, the call shows caution even after Apple posted strong fiscal Q4 results.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Long points to several risks that could limit future gains. These include slower iPhone demand in China, regulatory pressure on services, and an AI plan that remains unclear. In addition, he views the stock as fully priced after a strong run this year.

In the meantime, AAPL shares rose a modest 9.82% year-to-date.

How This Compares With Wall Street

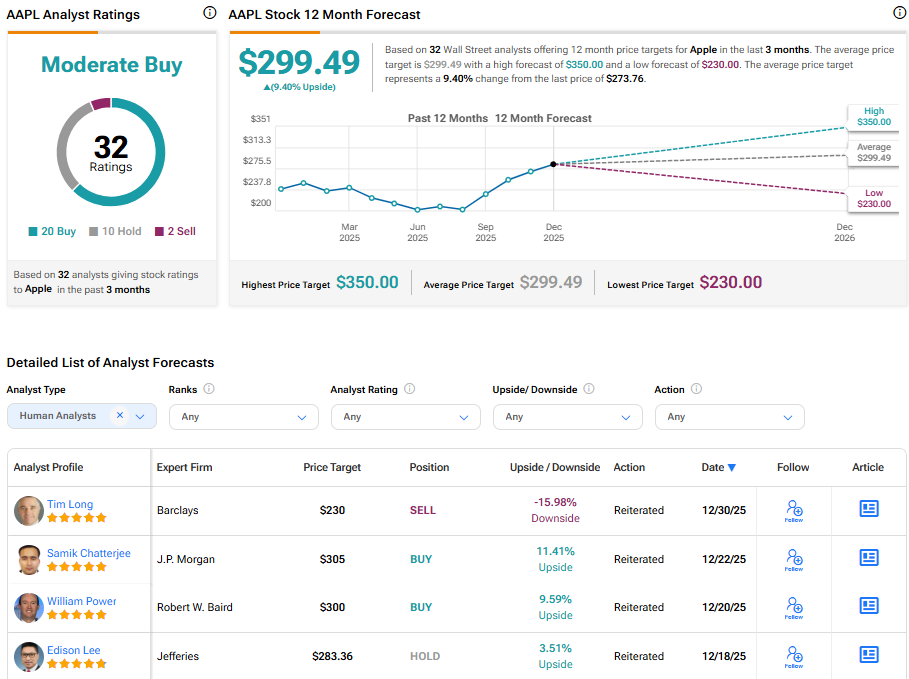

In contrast, most analysts remain more positive on Apple. The stock carries a Moderate Buy rating from about 33 to 37 analysts. Meanwhile, the average 12-month price target ranges from $230 to $350. Therefore, the broader view suggests limited downside and modest upside from recent prices near $265.

Analysts such as Morgan Stanley’s (MS) five-star Erik Woodring, who has a $315 target, continue to focus on service growth and a loyal user base. Overall, Long stands out as one of the few analysts who see more risk than reward at current levels.

Is Apple Stock a Buy, Hold, or Sell?

As stated above, Apple has a relatively positive view among the Street’s analysts, with a Moderate Buy consensus rating. The average AAPL stock price target is $299.49, pointing to a 9.40% upside from the current price.