Barclays analysts recently identified four U.S.-based government services firms with the highest exposure to Elon Musk’s DOGE-related contracts, warning they may face growing financial pressures. Barclays pointed Booz Allen Hamilton (BAH), CACI International (CACI), Leidos Holdings (LDOS), and Science Applications International Corporation (SAIC) as the firms with the greatest relative exposure.

Notably, DOGE (Department of Government Efficiency) is a budget-reduction initiative introduced during Donald Trump’s second term led by Elon Musk. The program focuses on slashing federal expenses and reducing the size of the workforce. Firms such as Booz Allen Hamilton, CACI International, Leidos, and SAIC are key players in the government contracting sector and secure multiple contracts with U.S. federal agencies.

Recently, consulting firm Accenture (ACN) warned of revenue risks as DOGE’s cost-cutting measures are hurting its sales.

Barclays Warns of Earnings Risk

According to Barclays, earnings per share could be at risk, particularly for companies generating up to 10% of their revenue from government work classified under the North American Industry Classification System (NAICS). Consequently, it believes facilities support services, technical consulting, and administrative management consulting are the most vulnerable sectors.

Additionally, Barclays noted that Booz Allen Hamilton derives 5% of its revenue from administrative management and consulting, with another 4% from professional and technical services.

Meanwhile, CACI International has 4% exposure to background check services and 2% to technical consulting. Leidos faces a key risk due to its 7% reliance on facilities support services, a sector that could be highly vulnerable to cost-cutting measures. While SAIC is vulnerable in professional training and legal services.

Barclays estimates that a 50% reduction in at-risk contracts could cut earnings by 2-3%, with SAIC seeing the largest hit at 3.2%, followed by Leidos at 2.3%.

Which Services Stocks Could Deliver the Highest Returns, According to Analysts?

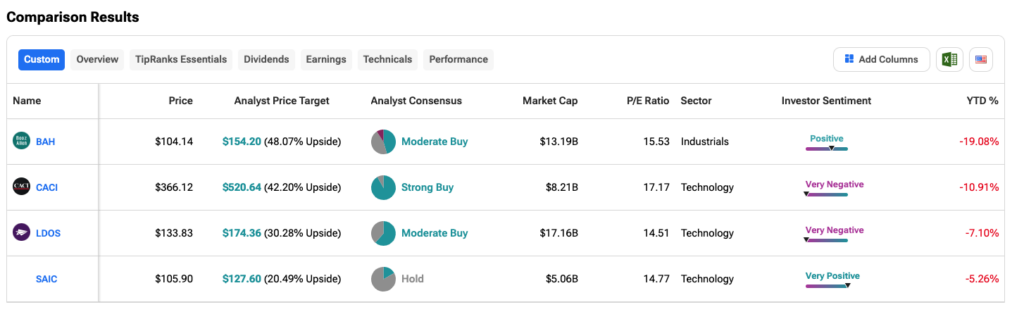

Using the TipRanks Stocks Comparison tool, we have compared these service stocks on different parameters. According to analysts, BAH stock offers the highest potential upside of 48% from current levels and carries a Moderate Buy rating. However, BAH stock has declined by almost 20% year-to-date.