Barclays (BCS) (GB:BARC) is changing how it deals with digital assets by investing in Ubyx, a platform that helps banks process regulated stablecoins. In the past, the bank was careful and even blocked some crypto-related payments. Now, this deal shows that Barclays wants to help build the tech “pipes” that move digital money around the world.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The bank is betting that regulated digital coins will soon become a normal part of how people and businesses pay for things.

Ubyx Links Traditional Banks to Digital Tokens

A major problem for big banks is that different digital coins don’t always work well together. Ubyx acts as a middleman to fix this. It connects banks with stablecoin makers like Ripple and Paxos so they can send money back and forth without errors.

Ryan Hayward, who leads digital asset investments at Barclays, explained the logic behind the move. He said: “As the landscape of tokens, blockchains and wallets evolves, specialist technology will play a pivotal role in delivering connectivity and infrastructure to enable regulated financial institutions to interact seamlessly.” This technology allows a bank to treat a digital stablecoin almost like a regular bank deposit.

Founder Tony McLaughlin Pushes for Global Digital Wallets

The man behind Ubyx is Tony McLaughlin, a former high-level executive at Citi (C) with decades of experience in the payments world. He wants to move the world away from old, slow banking systems and toward a single network for digital money.

McLaughlin explained his goal for the company. “Our mission is to build a common globalised acceptance network for regulated digital money including tokenised deposits and regulated stablecoins,” he said. He believes the future is a world where “every regulated firm offers digital wallets in addition to traditional bank accounts.”

New Rules Make Stablecoins Safer for Big Banks

Clearer laws passed in early 2026 have made it much easier for giant banks like Barclays to join the digital money race. These rules give banks a safety manual for how to handle tokens without breaking the law or losing money.

Barclays is choosing to invest in the clearing house, the system that settles the trades, rather than the coins themselves. This plan helps the bank earn money from the technology while avoiding the high risks usually linked to crypto markets.

Is Barclays a Good Stock to Buy?

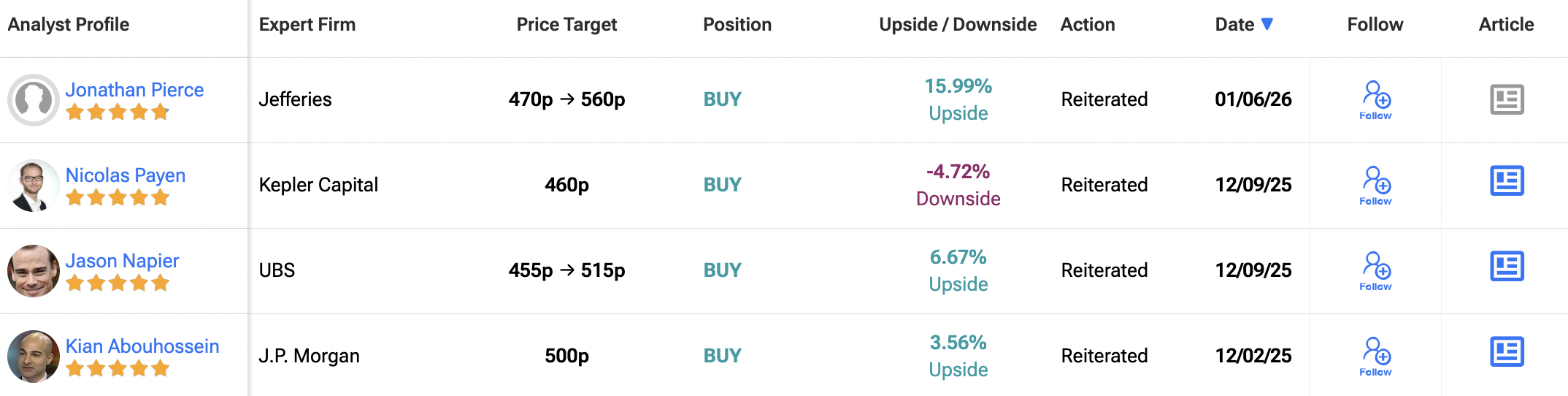

Turning to Wall Street, analysts have a Strong Buy consensus rating on BARC stock based on nine Buys and one Hold assigned in the past three months, as indicated by the graphic below. After an 83.8% rally in its share price over the past year, the average 12-month BARC price target of 493.33p per share implies 2.2% upside potential.