Banner Corporation (BANR), DocuSign (DOCU) and Macy’s (M) are some of the stocks to receive new ratings from our TipRanks AI Analyst.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Our TipRanks AI Analyst Top Stocks Screener Tool. helps investors scan stocks that our AI analysts have screened and ranked on a range of criteria from earnings results to technical analysis.

Let’s have a look at those new ratings:

New Three

Banner Corporation operates as the bank holding company for Banner Bank that provides commercial banking and financial products and services to individuals, businesses, and public sector entities in the United States.

Our AI analyst has given it a score of 92 and a Buy rating. It has a price target of $76, implying a 12.33% upside.

Its overall stock score is driven by strong financial performance and positive technical indicators. The company’s valuation is reasonable, and recent corporate events, including a stock repurchase plan, enhance shareholder value.

However, our AI guru also highlighted concerns about potential negative impacts on the West Coast economies due to policy changes and international tariffs, which could affect small businesses and consumers.

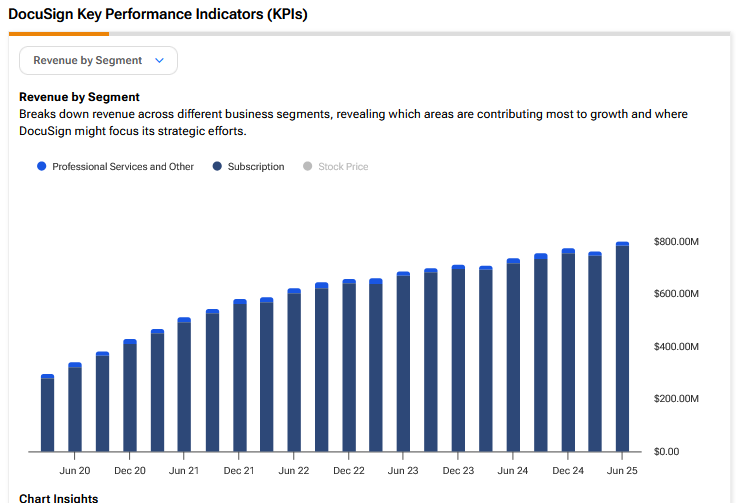

DocuSign provides electronic signature software in the United States and internationally. The company provides e-signature solution that enables businesses to digitally prepare, sign, act on, and manage agreements.

Our AI analyst has given it a score of 89 and a Buy rating. It has a price target of $87, implying an 8.94% upside. The overall stock score reflects its strong financial performance and positive earnings call insights, which highlight robust growth and strategic innovation. The technical analysis indicates moderate bullish momentum, though the high valuation suggests caution. The company’s focus on AI and market expansion positions it well for future growth, despite some margin pressures from cloud migration costs.

Our analyst adds that DocuSign has shown impressive growth in its revenue, with a notable increase from $1.45 billion in 2021 to $3.03 billion in TTM (Trailing-Twelve-Months) of 2025. The gross profit margin remains strong at around 79%, indicating efficient cost management.

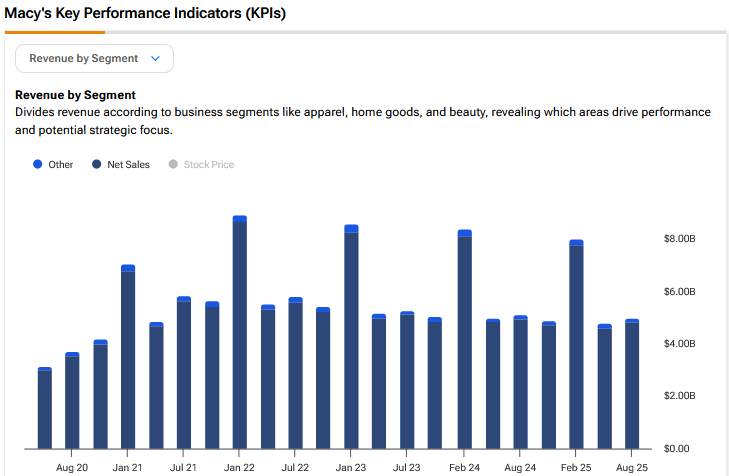

Macy’s is a leading omnichannel retail organization operating department stores and an online shopping platform. Established in 1858, Macy’s has become synonymous with American retail, offering a wide range of products including apparel, accessories, cosmetics and home furnishings.

Our AI analyst has given it a score of 87 and a Buy rating. It has a price target of $17.50 implying a 0.98% upside. Its overall stock score reflects a mix of financial challenges and positive technical momentum. The company’s low valuation and strong technical indicators are offset by declining revenue and profitability.

To find more AI Analyst stocks like these, check out our TipRanks AI Analyst Top Stocks Screener Tool.